Mumbai, Oct. 20: Reliance Industries Ltd (RIL) today reported a 23 per cent drop in second-quarter net profit, matching Street estimates.

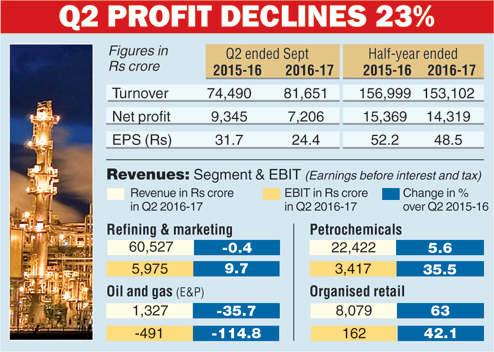

The company's consolidated net profit came in at Rs 7,206 crore for the second quarter ended September 30 against Rs 9,345 crore in the same period last year.

Analysts had expected the oil giant, which has expanded to other areas such as organised retail and telecom, to post profit in the region of Rs 7,200 crore.

Turnover was higher by nearly 10 per cent at Rs 81,651 crore over Rs 74,490 crore last year.

According to RIL, the increase in revenue was primarily on account of higher volumes in the refining, petrochemical and retail businesses.

Refining show

The quarter saw RIL performing better on the refining front. The gross refining margin (GRM) at $10.1 per barrel was marginally better than analysts' estimates of a single-digit number even as it was lower than $10.6 per barrel in the same period last year. GRM is the profit made from processing crude oil into other products.

The refining and marketing business saw revenues decreasing marginally to Rs 60,527 crore from Rs 60,768 crore.

However, the segment's earnings before interest and taxes (EBIT) grew nearly 10 per cent to Rs 5,975 crore over the same period last year, aided by stronger volumes.

RIL said its GRM outperformed the benchmark Singapore margin by $5 per barrel. During the quarter, the refineries processed 18 million tonnes of crude, which was 7 per cent higher on a sequential basis.

Revenues from the petrochemical business rose 5.6 per cent over last year to Rs 22,422 crore (Rs 21,239 crore) with segment EBIT soaring almost 35.5 per cent to a record level of Rs 3,417 crore.

RIL said the rise in the topline in the petrochemical business was primarily because of an increase in volumes of fibre intermediates and polyester products, while the EBIT was supported by strong volume growth and firm margin environment.

Further, robust demand growth during the quarter across polyester products and polymer underpinned segment earnings.

"The company has achieved outstanding second-quarter results with strong refining performance and record petrochemical earnings. The refining business sustained high profitability in a tough environment. The petrochemical segment gained significantly from higher volumes, integration and supportive product margins. Our hydrocarbon projects are at advanced stages of mechanical completion and precommissioning activities," Mukesh Ambani, chairman and managing director of RIL, said.

The retail business saw margins rise 42.1 per cent to Rs 162 crore. Revenues grew 63 per cent year-on-year to Rs 8,079 crore from Rs 4,956 crore in the year-ago period. During the quarter, Reliance Retail added 59 stores.

Telecom grouse

On Jio, which launched its commercial services on September 5, RIL said its customers continued to face severe service quality issues because of inadequate release of points of interconnection (PoIs) by the incumbent mobile operators.

"Call failure rates continue to be severe with over 75 calls failing out of every 100 attempts on the networks of some of the operators. This is in breach of quality of service regulation that not more than five calls of every 1,000 call attempts can fail. While Jio has rolled out a state-of-the-art network, the benefits of superior voice technology have been denied to public because of the PoI congestion," it added.