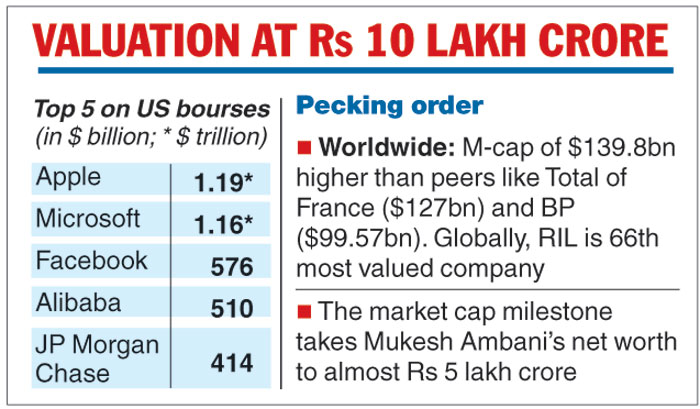

Reliance Industries Ltd (RIL) on Thursday became the first Indian company to have a market capitalisation of Rs 10 lakh crore ($139.8 billion) as its shares continued to rally. The oil-to-telecom conglomerate is now the world’s 66th most valued company ahead of entities such as BP and Netflix.

The RIL stock continued to rally on Tuesday and rose 0.65 per cent to close at Rs 1,579.95 on the BSE as it crossed the milestone.

During intra-day trades, the stock jumped 0.90 per cent to an all-time high of Rs 1,584. At the close, RIL’s market capitalisation shot up to Rs 10,01,555.42 crore. For Mukesh Ambani, who controls 50.01 per cent of RIL, the market cap milestone takes his net worth to almost Rs 5 lakh crore.

The Telegraph

The Reliance stock took only around 25 sessions for the market cap to rise from Rs 9 lakh crore to the current level. Market circles said that the stock’s rally could be attributed to several factors.

The company has almost completed its huge capital expenditure plan, which could play a positive role in improving its bottomline.

The consumer facing businesses, comprising organised retail and digital services, have also dished out robust performances over the past few quarters.

Other initiatives announced by Ambani,that include plans to bring down the net debt levels to zero by March 2021? and the move to create a holding company on the lines of Alibaba or Alphabet Inc, have also been well received by investors. More recently, there was another positive news when Jio announced that it would raise its tariffs.

“RIL has been a material outperformer year to date. Given strong news flow on de-leveraging, Jio strategic sale and tariff hikes, we would expect the outperformance to continue,” J.P. Morgan said in a research note.

J.P. Morgan said the share price could reach Rs 1,900 with the completion of the proposed transaction with Aramco, and the entry of a strategic investor into Jio and the organised retail business.

“We attribute this outperformance to a strong performance by retail, Saudi stake sale news, Jio strategic sale expectations, and telecom tariff hikes. Arguably all four events have not been fully priced in, and progress/completion could drive the stock higher and is the key upside risk,” the brokerage said.

New subsidiary

RIL told the stock exchanges it had incorporated a wholly owned subsidiary (WoS) for its digital platform initiatives.

Last month, RIL had announced the creation of the platform company in which it will hold 100 per cent of the subsidiary. The latter in turn will hold 100 per cent of Reliance Jio Infocomm Ltd.

“The company, as a subscriber to the memorandum of association of WOS, has invested Rs 1,00,000 to acquire 10,000 equity shares of WOS namely Jio Platforms Ltd (JPL). JPL was incorporated on November 15, 2019 and is yet to commence its business operations,” RIL said.