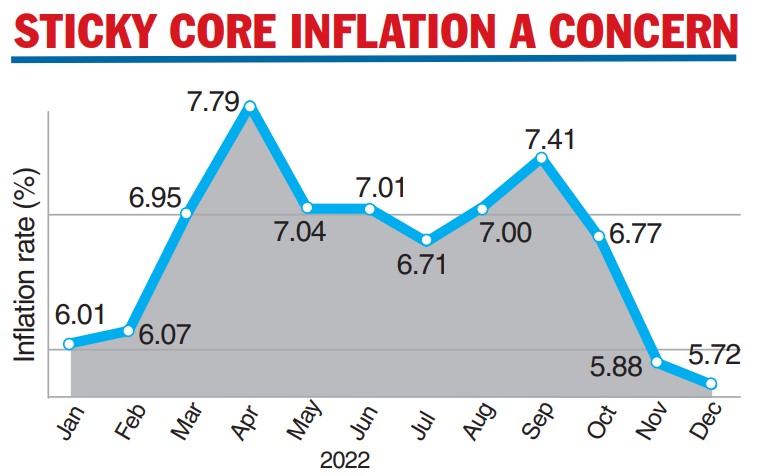

Retail inflation fell to a year’s low of 5.72 per cent in December and was below the RBI’s upper tolerance limit of 6 per cent for the second month in a row, which could give elbow room to the central bank to pause its rate hike cycle, economists said.

However, core inflation — which is overall inflation excluding the fuel and food prints — remained sticky at 6 per cent, limiting the options before the Reserve Bank of India (RBI). Core inflation has remained above 5.75 per cent for 20 months.

Retail inflation based on the consumer price index (CPI) was higher at 5.88 per cent in November. The previous low was 5.66 per cent in December 2021. Retail inflation is on a downward trajectory since October.

Sunil Kumar Sinha, principal economist, Indian Ratings and Research, said the inflation trajectory will depend on a combination of cereal prices, commodity prices and core inflation.

“Although the impact of monetary policy will gradually start reflecting in the cooling down of retail inflation in the coming months and the same is expected to drop to about 5 percent by the first quarter of 2023-24, Ind-Ra still sees a strong possibility of a 25bp rate hike in the February monetary policy committee review meeting. The terminal rate in present cycle is likely to be in the range of 6.50 per cent6.75 per cent,” Sunil Kumar Sinha, principal economist, Indian Ratings and Research, said.

Aditi Nayar, chief economist, Icra said: “The CPI inflation provided a positive surprise, dipping to a lower than expected 5.7 per cent in December 2022, dampened by a welcome fall in the food inflation, whereas most other sub-indices printed along anticipated lines.”

She said notwithstanding the welcome softening in prices of several essential commodities seen in early January and the healthy rabi sowing trends, an unfavourable base could cause the food inflation print to harden somewhat in the ongoing month.

“Taking into account today’s lower-than-expected CPI inflation print, and the muted average IIP growth of 1.3 per cent during October-November 2022, we anticipate MPC may choose to pause in February 2023,” she added.

According to data released by the National Statistical Office, inflation in the food basket was 4.19 per cent in December against 4.67 per cent in November and 4.05 per cent in December 2021.

In the vegetable basket, inflation dropped over 15 per cent on an annual basis. Fruit prices rose of 2 per cent.