The RBI had observed that only certain payment system operators and their outsourcing partners stored data either partly or completely in the country.

The banking regulator, which wanted unfettered supervisory access to all payment data, had said ensuring the safety and security of payment systems data and their continuous monitoring and surveillance is necessary to reduce the risks from data breaches.

Some overseas operators had then suggested the RBI should allow data mirroring where data is stored both in India and global servers. However, this has not been accepted by the regulator.

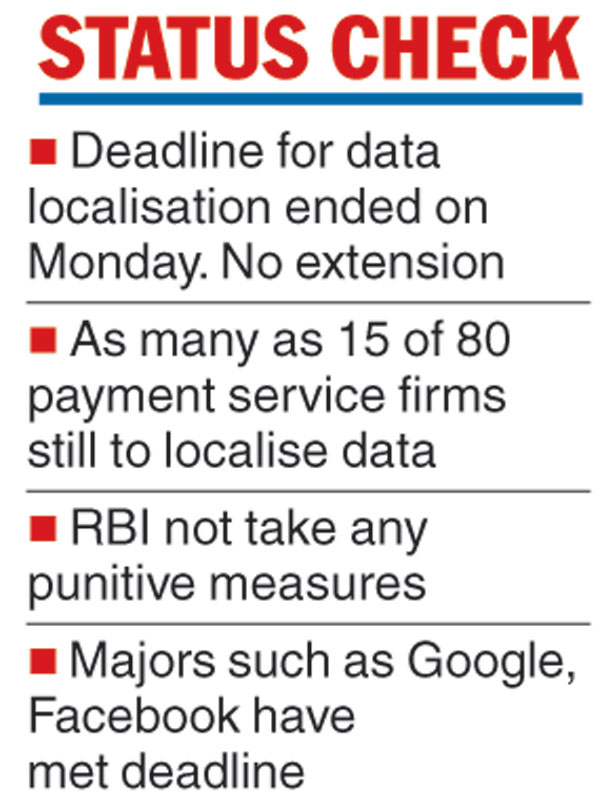

Some of the overseas players who have complied with the deadline include Google, Facebook, Alibaba and Amazon. Bloomberg reported both Visa and Mastercard will miss the deadline and they have sought an extension. Sources, however, said that customers are unlikely to be affected.

The RBI has also got the support from the Union government. ``We are not in favour of extension. Also, data mirroring is not an option,” the official told reporters in New Delhi on Monday.

The Telegraph

The Reserve Bank of India (RBI) did not extend Monday’s deadline that mandated payment service firms to store data inside the country. The central bank’s efforts in this direction have yielded fruit with most of the operators complying with the rule and others making “significant progress”.

Sources from the industry told The Telegraph that of the 80 payment service companies that will now have to store data locally, close to 15 entities that include two of the world’s leading card companies have been unable to meet the deadline. However, it is learnt that the central bank is not taking a harsh stand with regard to these entities.

“They have been told to report to the RBI on the steps they are taking to meet the data localisation requirement. The RBI is ascertaining whether the delay was due to genuine difficulty. The central bank is not condemning such firms to the guillotine. If there is some genuine reason, they are likely to be given more time,’’ the sources added.

The RBI, which also regulates payment systems in the country, in April had said that all payment system providers must store details of full end-to-end transactions (that are done in India) only in the country within a period of six months. The RBI had then also directed the system providers to report their compliance to it by October 15.