Reserve Bank of India (RBI) governor Shaktikanta Das is set to meet representatives of micro, medium and small enterprises (MSMEs) next week even as the representatives from the sector have expressed dissatisfaction with the restricted conditions attached to the one-time loan restructuring scheme announced by the central bank on Tuesday.

The MSMEs are demanding that the scheme should be extended to cover firms that are not registered under the goods and service tax (GST).

RBI governor Shaktikanta Das tweeted: “Will hold meetings with MSME associations and representatives of NBFCs next week.”

Das had earlier met the heads of various PSU and private sector banks.

The RBI also said it will form an expert committee to identify the issues and propose long-term solutions for economic and financial sustainability of small businesses. The panel will be headed by U.K. Sinha, former chairman of the Securities and Exchange Board of India, according to a press statement published on the central bank’s website.

Das’s meeting with MSMEs could see their representatives raking up the issue of exclusion of non-GST registered units from the restructuring scheme.

“The borrowing entity should be GST-registered on the date of implementation of the restructuring,” the RBI had said while citing the conditions of the mechanism.

“It would have been far more effective if the scheme covered all MSMEs, GST-registered or not, as a large number of units are adversely affected due to delays in payments owing to stressed economic conditions as a result of the twin shocks of demonetisation and GST,” Federation of Indian Micro and Small and Medium Enterprises secretary-general Anil Bhardwaj said.

The Telegraph

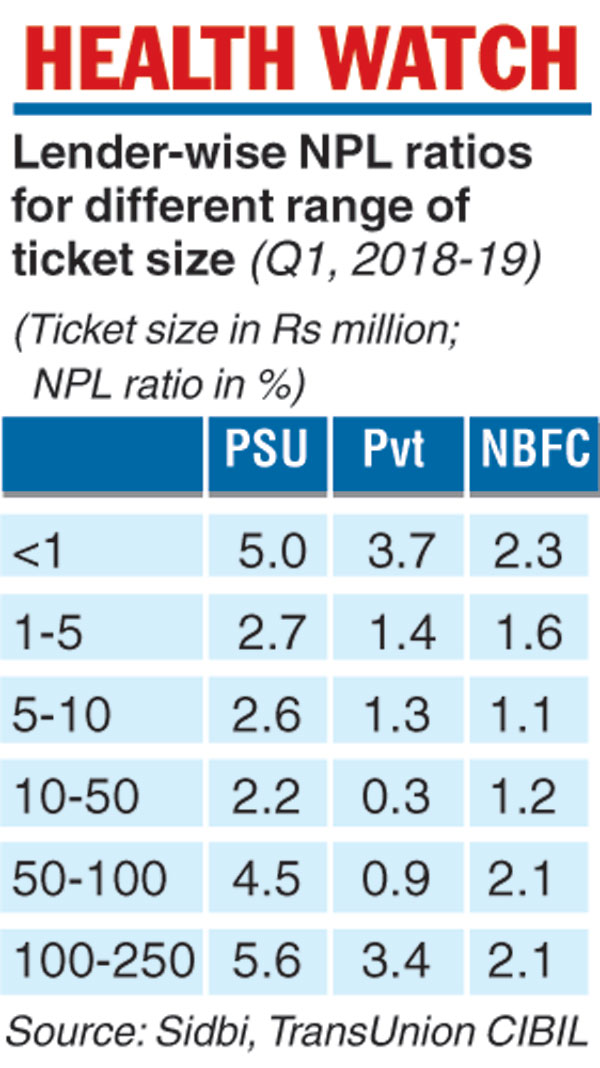

But the controversy over the scheme has been further inflamed by brokerage analysts who have expressed surprise over the timing of the notification and the rationale for a loan bailout plan for small and medium firms when there is no data to buttress the need for forbearance as lenders are not reporting any rising trend in loan impairment.

On Tuesday, the central bank announced a one-time restructuring of loans to the sector that are in default but treated as a “standard asset” on the books of the banks as on January 1, 2019. A restructuring of a loan account happens when certain changes are made to the conditionalities attached to the loan that may include an extension of the repayment tenure.

A report put out by Kotak Institutional Equities said that the overall exposure of banks and NBFCs is Rs 13 lakh crore (of loans up to Rs 25 crore) of the overall Rs 23 lakh crore MSME portfolio.

A note from Icra estimated that MSME loans under the forbearance stood at less than Rs 10,000 crore as on September 30, 2018.

Analysts expressing bewilderment over the bailout plan for MSMEs, which stood in stark contrast to Prime Minister Narendra Modi’s stand that his government would not step in to bailout farmers who have been similarly plagued by loan distress.

In its note, Kotak Institutional Equities said the forbearance comes as a surprise move as the lenders are not witnessing any build-up of stress in the segment.