The Reserve Bank of India on Monday postponed the three-day meeting of the monetary policy committee that was scheduled to begin on Tuesday but gave no reason for the unprecedented decision.

One possible reason is that the committee lacked the quorum to meet after the government failed to name the replacements for the three independent members whose four-year term ended in August.

The three independent members of the MPC — Chetan Ghate, Pami Dua and Ravindra Dholakia — had been appointed in 2016.

Under the RBI Act, the independent members of the committee cannot be reappointed after their terms end. At the same time, the six-member MPC has to have a quorum of four with at least one of them being the RBI governor or the deputy governor.

The three independent members of the MPC are appointed by the central government. It isn’t clear why the Narendra Modi government chose to drag its heels on the appointment of the new members.

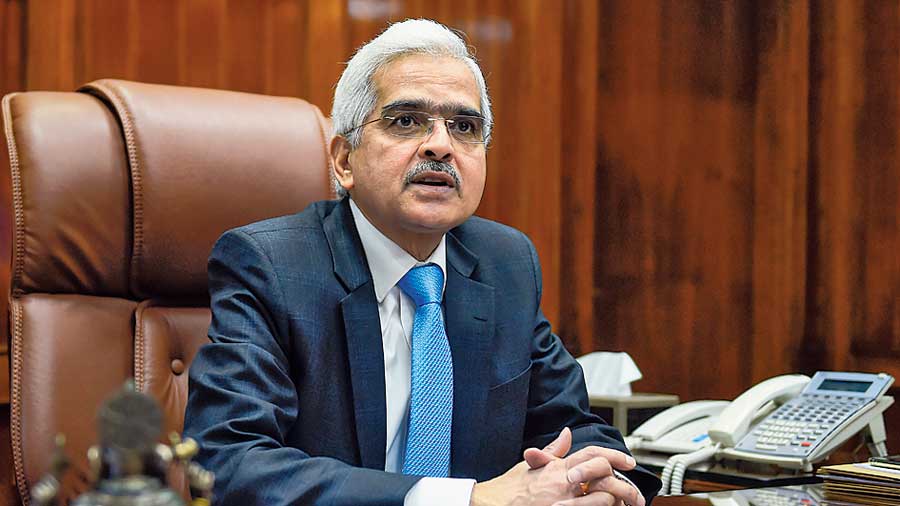

The failure to do so has turned the rump MPC of RBI governor Shaktikanta Das, deputy governor Michael Patra and executive director Mridul Saggar into a sort of lame-duck panel.

The MPC principally sets the policy interest rates that determine the course of lending and deposit rates in the financial system.

The MPC has a mandate to cap retail inflation within a tolerance band of 2 to 6 per cent. The inflation anchor for monetary policy has determined the trajectory of interest rates within the financial system.

Retail inflation has been running far above the upper limit of 6 per cent since January, a key reason why the MPC decided at its meeting in early August to hit the pause button after cutting the policy interest rate — the repo — by 250 basis points since February 2019.

If the rate stays above the 6 per cent level or below 2 per cent for three consecutive quarters, it will be deemed a failure on the MPC committee’s part to meet its mandate, making it obligatory to submit a report explaining the reasons for the failure and a remedial plan to bring it within the band. The committee has a small escape route to avoid such an ignominy: the pandemic forced the National Statistical Office to skip the number for April because of poor data collection during the lockdown.

Banks have been tardy in passing on the rate cut benefit to their borrowers -- a situation that has boiled into a major concern for retail and corporate borrowers who have been struggling to deal with the crisis thrown up by the pandemic.

The RBI was widely expected to skip a rate cut this time as well. At a recent videoconference, governor Das said he would not want to speculate how the new members of the MPC would vote.

Each MPC has one vote on the panel. If there is a tie, the governor has a casting vote. The members representing the RBI have been fairly consistent in their stand and were widely expected to vote down a request from the government for a rate cut.

Odd lethargy

The delay in appointment of the three independent members reflects an uncharacteristic lethargy within the Modi government in making the new appointments — an almost wilful indolence that contrasts sharply with the alacrity it has displayed in passing the contentious farm sector reform bills or disclaiming its responsibility to pay GST compensation to the states.

Observers said the delay could have been easily averted since the government knew only too well that the three new members had to be appointed last month.

The RBI waited till the last moment for a government announcement on the new members before announcing the decision to defer the MPC meeting.

There is no word on when the MPC will be reconstituted or indeed when it will meet.

“The meeting of the MPC during September 29, 20 and October 1, 2020 ...is being rescheduled. The dates of the MPC’s meeting will be announced shortly,” the RBI said in a terse media release on Monday morning.

The RBI has been under pressure from the government to do the heavy lifting by deploying conventional and unconventional monetary policy tools to revive a floundering economy, which contracted by 23.9 per cent in the first quarter ended June 30 and is expected to shrink by anywhere between 12 and 14 per cent in the second quarter as well.

All the well-known forecasters have reworked their projections and now expect the Indian economy to contract by at least 5 per cent this fiscal.

With the Centre continuing to double speak on the prospects for a second stimulus package, there are worries that there isn’t enough demand in the economy to reignite the engines of growth.

Several economists have advised the government to spend its way out of trouble but it chooses not to listen.

“The economy is facing a serious challenge and the RBI has been leading from the front with quick responses through rate cuts, injecting liquidity through open market operations, long term repo operations (LTROs) and a variety of innovative tools to manage and ensure financial stability. In this hour of economic emergency, the MPC has to be in place to formulate its policy. This delay could have been avoided,” said V.K. Vijayakumar, chief investment strategist at Geojit Financial Services.