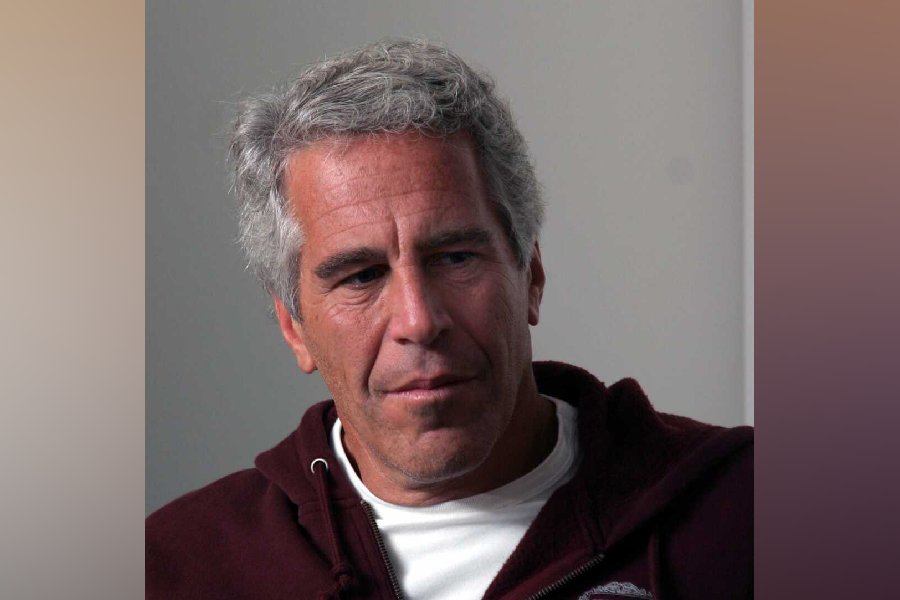

RBI governor Shaktikanta Das on Wednesday said that the central bank was “battle ready’’ to crank up the economy as he gave priority to growth over inflation, which has been well above the tolerance level.

Das said the RBI was prepared to take whatever measures to revive the economy, which contracted at a shocking 23.9 per cent in the April-June quarter, even as retail inflation at 6.69 per cent in August remained above the medium-term target of 4 per cent plus or minus 2 per cent for the for the fifth straight month.

At its meeting last month, the monetary policy committee (MPC) of the RBI had left the policy repo rate unchanged because of concerns over inflation.

The latest comments from the RBI governor will keep hopes alive of an interest rate cut from the MPC at its October meeting.

Addressing a virtual conference organised by industry body Ficci, Das said the contraction of 23.9 per cent in the first quarter was a telling reflection of the ravages of Covid-19.

However, high frequency indicators such as agricultural activity, the purchasing managers’ index (PMI) for manufacturing and private estimates of unemployment point to some stabilisation in the second quarter amid several sectors reporting easing in contraction.

But at the same time, the recovery is not yet fully entrenched and in some sectors, the uptick seen in June and July is easing. “By all indications, the recovery is likely to be gradual as efforts towards the reopening of the economy are confronted with rising infections,” Das said.

The RBI governor said the immediate policy response was to focus on stabilisation along with quick recovery policies in the medium term.

Ficci chairperson Sunita Reddy said the private sector was afraid of getting crowded out of the loan market as the government could increase borrowing because of the poor state of its finances. The Centre has announced a record borrowing of Rs 12 lakh crore for this fiscal.

Das allayed Reddy’s fears as the borrowing costs in the economy were at their lowest levels in a decade.

“Despite substantial increase in government borrowing programme, large surplus liquidity conditions has facilitated non-disruptive mobilisation of resources at the lowest borrowing costs in a decade, the RBI governor said.

Moreover, Das said that benign financing conditions and the substantial narrowing of spreads have spurred a record issuance of corporate bonds of close to Rs 3.2 lakh crore during 2020-21 up to August.

Loan recast

Commenting on its one-time restructuring scheme, Das said that the interests of depositors and financial stability were kept in mind while framing the mechanism.

“The primary concern of any banking system should be the protection of the depositors’ interest... so, on the one hand we had to keep in mind the interest of the depositors, the need to maintain financial stability, the stability of the banking sector as we don’t want a repeat of the situation which India experienced a few years ago where the NPA levels of banks had gone up very steeply,” he said.

At the meeting, the RBI governor told the industry leaders to focus on five areas which would sustain India’s growth in the medium-run.

These included human capital, in particular education and health, productivity, exports, which is linked to raising India’s role in the global value chain, tourism and food processing.

Bank bill passed

In a bid to protect the interest of depositors, the Lok Sabha on Wednesday passed an amendment to the Banking Regulation Act to bring cooperative banks under the supervision of the RBI.

The Banking Regulation (Amendment) Bill, 2020 replaces an ordinance that was promulgated on June 26.

Finance minister Nirmala Sitharaman said the legislation was designed to protect depositors’ funds and would not undermine the powers of the Registrar of Co-operative Societies. The powers of the registrar have not been encroached upon but the banking activity of co-operatives will be regulated by the RBI, she said.