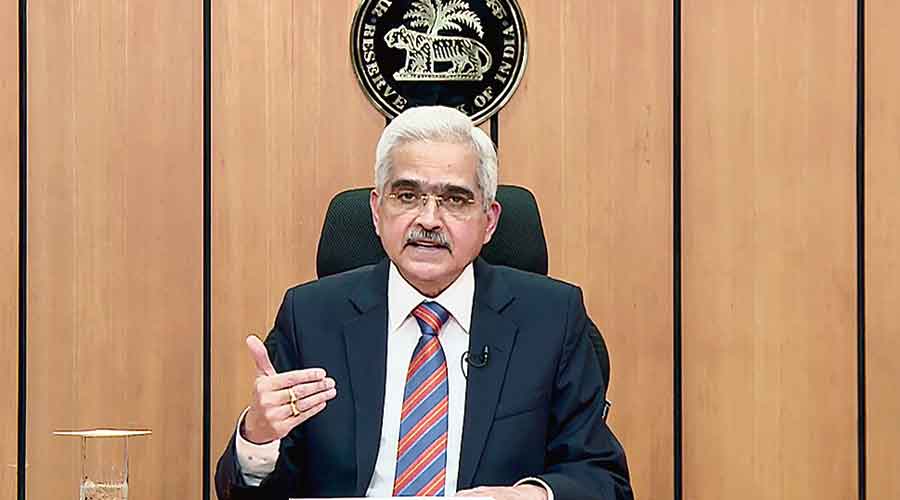

RBI governor Shaktikanta Das has asked banks to take proactive measures to strengthen their resilience and lending capacity by raising capital, the central bank said in a statement on Wednesday.

During a two-day meeting with the heads of banks, including the private sector lenders, the governor emphasised on the need to remain vigilant and make provisions against bad loans proactively.

Das had held similar meetings in May as well. He had also met representatives of other financial institutions such as NBFCs and microfinance lenders.

The RBI, in its statement, said Das held meetings with the MDs and CEOs of public sector banks and select private sector lenders on Tuesday and Wednesday, respectively, through video conferencing.

The meetings were also attended by the RBI’s deputy governors.

During the meetings, Das touched upon the current economic situation and emphasised on the importance of the banking sector to support the ongoing revival in economic activities, the RBI said.

With specific reference to the financial sector, he highlighted the measures taken by the central bank since the onset of the pandemic to stabilise the economy and ensure financial stability.

“With regard to the banking sector, he reiterated the need for banks to remain vigilant and take proactive measures to strengthen their resilience and lending capacity by raising capital and making provisions proactively,” the RBI said.

Assessment of the current economic situation and outlook; and monetary policy transmission and liquidity situation too came up for deliberations.

The release further said credit flow to different sectors, including stressed segments and MSMEs, was discussed.

Other issues which came up for discussion included progress in the implementation of resolution framework for Covid-related stressed assets; progress in making the identified districts in states/UTs 100 per cent digitally enabled and improving grievance redress mechanisms.

Digital lending caution

The Reserve Bank on Wednesday cautioned the public not to fall prey to the growing number of unauthorised digital lending platforms and mobile apps.

In a release, the Reserve Bank noted that there have been reports about individuals/small businesses falling prey to such unauthorised platforms and apps which promise quick and hassle-free loans.