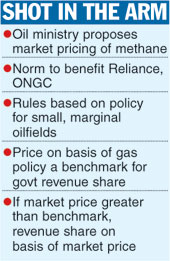

New Delhi, Sept. 18: The oil ministry has proposed the market pricing of coal bed methane (CBM) to make it attractive to investors. The move will benefit Reliance Industries and ONGC, which plan to start production from their blocks.

The oil ministry has sent a draft cabinet note for inter-ministerial consultation proposing "market pricing for CBM", a senior ministry official said.

CBM is a natural gas trapped within coal formations that can only be extracted by drilling holes into the seams. The pricing policy will be similar to the policy for marginal oil and gasfields, for which bids must come by October, officials said.

The marginal field policy approved by the cabinet allows for the grant of a single licence for exploiting conventional and non-conventional hydrocarbons. It lifts the restriction on exploration activity during the contract period and exempts explorers from paying cess and customs duty on machinery and equipment.

Contractors will be free to sell the crude exclusively in the domestic market through a transparent bidding process on an arm's length basis. However, for the sake of the calculation of government revenue, the minimum price will be the price of the Indian basket of crude.

"If the price arrived through bidding is more than the price of the Indian basket, the government's take will be calculated based on the actual price realised," the oil ministry said.

Similar to the small fields, contractors will have the freedom to price methane on an arm's length basis. The government's share of revenue will be calculated in accordance with the natural gas pricing guidelines that led to a price of $3.06 per mBtu (million British thermal unit) on gross calorific basis for methane.

If the discovered price is more than the calculation based on the guidelines, the government's share will be determined by the actual price.

The existing pricing regime has created a divide in the industry with Essar Oil and GEECL - two companies producing CBM - selling methane at pre-approved (high) prices of $6 and $15 per mBtu, respectively,

RIL plans to start CBM production from its Sohagpur (West) block in Madhya Pradesh later this fiscal, while state-run ONGC is developing the Bokaro block in Jharkhand. If the new pricing policy comes into effect, it will help them.

ONGC officials have said they would like the gas price to be at least $5.5 per mBtu to meet the exploration cost.

ONGC has four CBM blocks - Jharia, Bokaro and North Karanpura in Jharkhand and Raniganj North in Bengal.

The Centre has awarded 30 blocks in four bidding rounds and three blocks on a nomination basis. The last round of bidding took place in 2008.