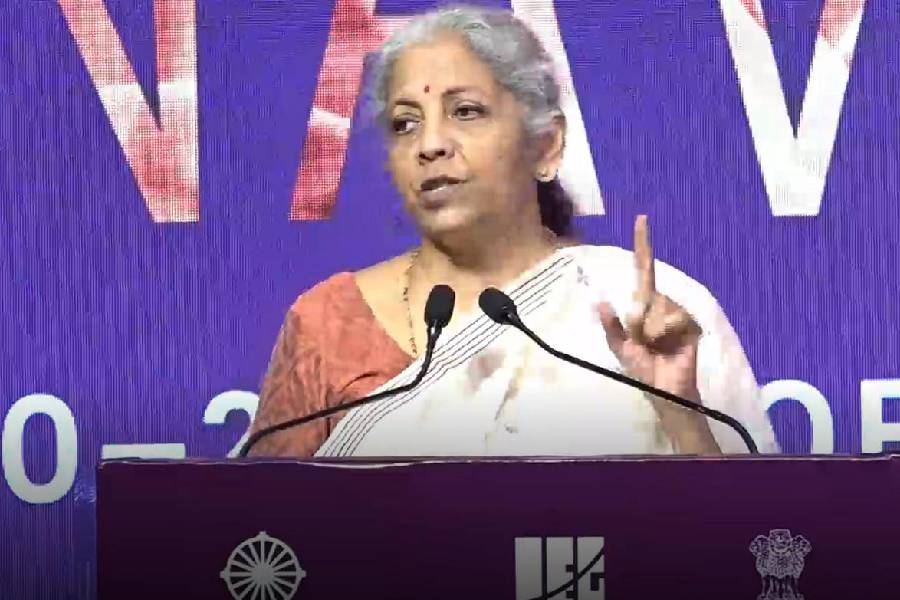

The government is looking at ways to reduce the level of central government debt, finance minister Nirmala Sitharaman said at an economic conference on Friday.

Sitharaman said the government is mindful of fiscal deficit management and will ensure the burden of servicing debt is not passed on to the next generation.

"We are conscious of matters related to the macroeconomic stability of the country and responsibility with which we deal with our fiscal and also the fiscal management."

"And so for every decision that we take today, we are conscious of what burden is going to leave for the next generations," she said.

It is very easy to be profligate and burden the coming generations with the debt that you will be sitting with, she said.

"We are conscious of the debt of the government of India. Compared to many others, it might not be as high as it is, but even then, we are consciously looking at experiments in different parts of the world," she said.

She said the government is actively looking at data related to debt of some emerging market countries and how they are managing them.

Credit rating agencies have raised concerns about mounting debt in India (Centre and states) which is currently at 89.26 per cent of GDP.

The Modi government aims to bring down overall debt to 60 per cent with central debt capped at 40 per cent, leaving the rest for states.

The government is successful in managing the debt burden because efforts are very well streamlined to meet India's aspirational requirements, but deal with it with a sense of responsibility so that coming generations don't feel the burden, she said.

During Covid, she said, the government spent public money on public infrastructure so that there was a better return for every rupee rather than go by the temptation of giving money to the hands of people who were suffering.

"Jan-Dhan accounts have been the biggest instrument of bringing financial inclusion to the country. When it was launched in 2014, people raised questions... today, these Jan-Dhan accounts have a cumulative balance of more than Rs 2 lakh crore," she said.