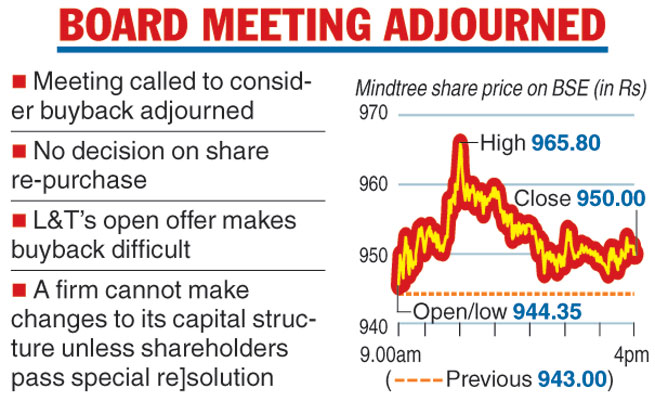

The guessing game continued in the Larsen & Toubro-Mindtree saga as the board of the mid-tier IT services firm on Wednesday adjourned a meeting called to consider a proposal to buy-back its shares. No decision was taken with regard to the share re-purchase.

The development should not come as a surprise given the regulatory hurdles to a buyback as L&T has announced an open offer. The next step of the company remains to be seen with its promoters “unconditionally” opposing the hostile takeover attempt by the engineering & construction conglomerate.

“The board considered the proposed buyback of equity shares of the company... Following detailed discussions, the meeting has been adjourned to a future date. No decision has been taken in relation to the proposed buyback of equity shares,’’ Mindtree said in a communication to the bourses after market hours.

Though the company did not disclose the reason for the adjournment of the meeting, market circles said it could be on account of Sebi norms that say after an open offer is announced, a company cannot proceed with a buyback.

The rules also say that a firm cannot make changes to its capital structure unless approved by shareholders through a special resolution where 75 per cent of shareholders support the decision. This may be difficult in the current circumstances with L&T already acquiring 20 per cent of the company from V.G. Siddhartha of Café Coffee Day.

The Telegraph

The focus has now shifted to the next step the company could take to fend off L&T. On Tuesday, when asked about the options, Mindtree executive chairman Krishnakumar Natarajan said there were various options and the company remains 100 per cent committed to its long-term vision to build an independent firm.

L&T had late on Monday announced the acquisition of a 20.3 per cent stake held by Siddhartha and two other entities at Rs 980 per share for a consideration of Rs 3,269 crore. It also announced an open offer to purchase up to 31 per cent

(Rs 5,030 crore) from the minority shareholders of Mindtree and another 15 per cent, which would cost it Rs 2,434 crore. The deal will cost the company Rs 10,733 crore.

According to a note from Motilal Oswal, the promoters of Mindtree with a 13.3 per cent stake may look to resist the hostile takeover by engaging with other shareholders, and it could turn out to be a long-drawn process.

“Post L&T’s purchase of the largest investor’s stake and Mindtree promoters’ intent to keep further advances at bay (contrary to L&T’s interests), the future is clouded with some uncertainty, but the ‘battle’ is unsettling, which is a potential risk to retention of key employees and also clients.

The turn of events may be understandably unsettling for some employees/clients, where the risks of attrition cannot be ignored. The development may also consume a substantial bandwidth of the founders and key personnel in the business,’’ the brokerage added.