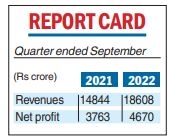

ITC Ltd has reported a 25.35 per cent jump in revenue from operations and a 24 per cent rise in profit on a consolidated basis in the second quarter of the fiscal as every segment of the conglomerate improved their performance significantly.

Revenue from operations stood at Rs 18,608 crore in Q2FY23 over Rs 14,844.38 crore in the same period last year. Profit for the period stood at Rs 4,670.32 crore, up from Rs 3,763.73 crore in Q2FY22, beating estimates of analysts.

Every major segment of the conglomerate, from tobacco to FMCG, from hotels to agri business and paper and paperboard recorded robust jump in profit and revenue in the second quarter.

Taking advantage of the stable tax regime and deterrent actions by enforcement agencies, the company continued to make volume recovery from illicit trade in cigarettes.

The year-on-year volume growth at 22 per cent was ahead of the market consensus of 15 per cent, noted Abneesh Roy, executive director of Nuvama Institutional Equities.

Cigarette segment revenue went up to Rs 7,635.38 crore from Rs 6,219.84 crore on Y-o-Y basis in the Q2FY23. Pre-tax profit from this segment was Rs 4,634.82 crore compared with Rs 3,762 crore in Q1FY21.

Non-tobacco FMCG segment, which includes food and health and personal care products, also reported a healthy jump in pre-tax profit at Rs 323.98 crore, up from Rs 206.87 crore in Q1FY22. Segment revenue went up to Rs 4,894.26 crore from Rs 4,043.83 crore in the same quarter last fiscal.

A statement from the company noted that strong growth across channels and markets (rural and urban) was witnessed, driven by a ramp-up in outlet coverage. ITC mitigated sharp escalation in input costs by cost management, premiumisation, supply chain agility and pricing actions.

Hotel business also turned the corner on a Y-o-Y basis with a profit of Rs 86.85 crore compared with Rs 49.48 crore loss on a segment basis. The company reported average room rate and occupancy reaching pre-pandemic levels.

ITC’s agri-business reported higher profit Y-o-Y at Rs 355.94 crore compared with Rs 298.18 crore a year ago. Paper and paperboards recorded Rs 629.78-crore profit against Rs 409.04 crore a year ago.