Heavyweight Reliance Industries Ltd (RIL) on Monday propelled benchmark indices to fresh lifetime highs, though the global sentiment soured following unprecedented protests in China against the state’s zero Covid policy.

A drop in crude oil prices and continued support from foreign portfolio investors (FPIs) also contributed to India’s uncoupling from various global indices.

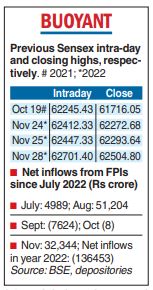

Rallying for the fifth consecutive session, the Sensex rose 211.16 points or 0.34 per cent to end at 62504.80, a new closing high after climbing 407.76 points or 0.65 per cent to its lifetime intra-day peak of 62701.40. At the NSE, the NSE Nifty gained 50 points or 0.27 per cent to end at 18562.75, its record closing high.

Wall Street brokerage Morgan Stanley has pencilled in an “absolute upside with relative downsides” for the domestic equity markets with the Sensex rallying 10 per cent in a base case scenario in 2023 scaling to 68500 points by December.

In a report penned by its chief India economist Ridham Desai and his team, the brokerage said, “An up-trending profit cycle, a likely peak in short rates in Q1 2023 and ebbing global macro risks relative to 2022 make the case for ‘absolute upside’ to Indian stocks.”

The feat came on the back of a nearly 3.50 per cent gain in the shares of RIL which shot up to a day’s peak of Rs 2,721.60 and ended 3.48 per cent higher at Rs 2,708.95 on the BSE.

In Asia, the markets in Seoul, Tokyo, Shanghai and Hong Kong ended lower, while the bourses in Europe were trading in the negative territory in noon trades. The sentiment was affected as the protests in China triggered concerns that its economy is headed for a further slump.

Despite the peaks attained by the benchmark indices, experts are cautioning that valuations at least in certain pockets are looking expensive.

“Indian markets are defying global weakness and touching all-time high. This is on the back of renewed interest from FPIs as the Indian decoupling story continues to play out. However, one must also realise that as we continue to see better growth rates than the world, our valuations too are priced at those premiums,” Srikanth Subramanian, CEO, Kotak Cherry, said.

“Even long-term investors should not betray discipline. One should ideally avoid any extreme movements and stick to the core asset allocation.’’

Observers said that despite worries of a recession hitting some of the global economies next year, the current rally is on account of better-than-expected corporate results, optimism that central banks would tone down their aggressive interest rate hikes, and inflows from FPIs and retail investors. Moreover, the domestic economy has also been resilient as reflected in 17 per cent growth in bank credit.

Ajay Menon, MD & CEO, broking and distribution, Motilal Oswal Financial Services, said the momentum will remain strong with an expectation of Nifty earnings CAGR of 17 per cent over two years.

“The oil prices have corrected 15 per cent and fallen to $80 per barrel. Even the wholesale and the retail inflation has cooled off and is showing signs of peaking out,” he said.