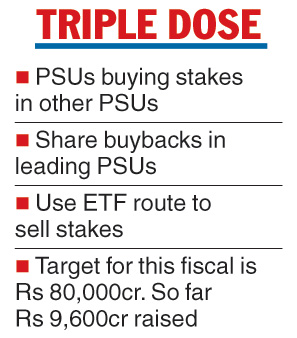

North Block plans to use a series of mergers and acquisitions by PSUs of other public sector units, selling stakes to state-owned ETFs as well as share buybacks to fulfil the government’s divestment targets.

While the government needs to raise around Rs 80,000 crore through disinvestment this year, it has till now raised a mere Rs 9,600 crore.

Turbulence in the market has stalled a number of planned IPOs of PSU entities. The government has consequently decided that the best way forward is to push acquisitions by other PSUs, share buybacks and through another ETF.

The finance ministry plans to sell around a 64 per cent stake in a smaller hydel power firm SJVN to NTPC Ltd.

Also in the pipeline is selling 65 per cent equity in Power Finance Corporation to Rural Electrification Corp Ltd.

The ministry is also believed to have identified a dozen PSUs — NTPC, NBCC, Kudremukh, Neyveli Lignite, NMDC, Nalco and Coal India — to buy back their shares using up reserves.

The boards of three PSUs — Nalco, NLC and Cochin Shipyard — have already approved share buybacks together worth Rs 2,000 crore.

However an attempt to get some other PSUs to do the same has backfired with some of them protesting that they did not have the sufficient reserves.

“This is really taking money from one pocket and putting into another. Earlier, the Centre had the right to do so as these were government-owned companies. Now that they are listed and there are private shareholders, how ethical this is, is a question which may crop up,” said Amit Mukherjee, an independent merchant banker working on behalf of East Asian funds.

It also often causes piquant situations. HPCL was last year sold to ONGC. However, HPCL’s managing director refuses to report to the ONGC top brass.

Officials said though high-profile strategic divestments such as that of Air India have been put off in view of the impending general elections, a few strategic sales of insignificant PSUs may happen though these will not fetch much money.

The government has identified land and other assets of these PSUs which will be hived off before they are sold.

It is also planning another exchange-traded fund which may sell abroad by issuing GDRs in the London market.

The Telegraph