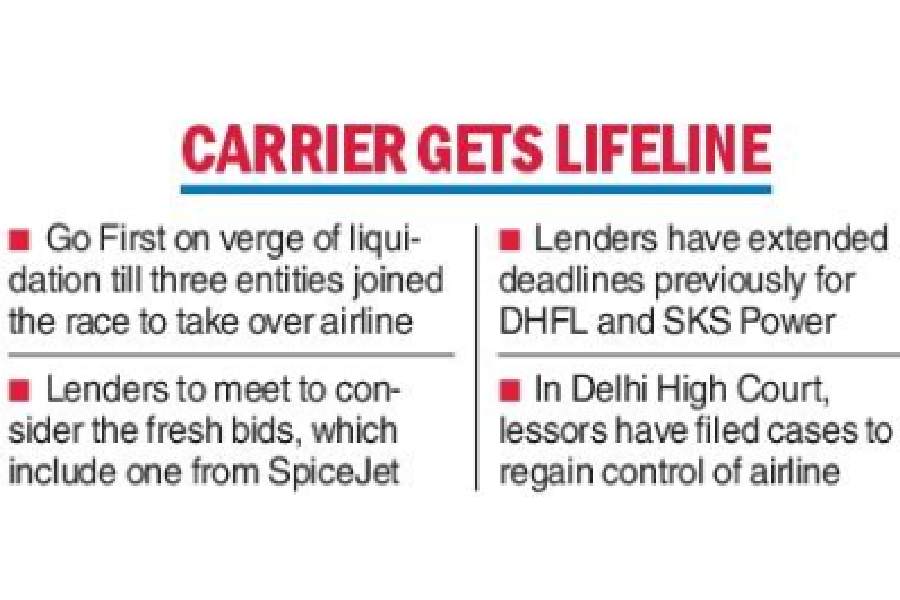

The committee of creditors (CoC) of Go First are likely to meet shortly to decide on the fresh bids from three entities for the beleaguered carrier, which was on the brink of liquidation.

Shailendra Ajmera, the resolution professional (RP), who is overseeing the airline’s resolution process, has reportedly received interest from three parties — SpiceJet, SkyOne a Sharjah-based aviation firm and Africa-focussed Safrik Investments.

While the three entities have sought an extension of the deadline, sources said the lenders will meet within the next few days to take a call on whether this should be done or the airline should go into liquidation.

The last date for the submission of bids for acquiring Go First was November 22.

The National Company Law Tribunal (NCLT) had extended the resolution process for the carrier till February 2024.

Earlier, there were instances of lenders extending the deadline for bidders to submit fresh resolution plans that included Dewan Housing Finance Ltd or DHFL, which was subsequently acquired by the Ajay Piramal group.

SKS Power is another case: banks in December last year had extended the due diligence deadline for potential buyers.

Go First has stopped flying since May 3.

A week later, the National Company Law Tribunal (NCLT) admitted the airline’s voluntary insolvency resolution petition.

The carrier owes more than Rs 6,200 crore to various creditors. It remains to be seen if the creditors will take the fresh interest seriously.

Incidentally, SpiceJet which has been facing financial difficulties, recently announced plans to raise more than Rs 2,250 crore through the issue of shares and warrants to 64 entities, including financial institutions and FIIs.

It will issue preference shares to various investors, including Elara India Opportunities Fund, Aries Opportunities Fund, Mahapatra Universal Ltd, Nexus Global Fund, Prabhudas Lilladher and Resonance Opportunities Fund.

While Jindal Power, the Naveen Jindal firm, had in October submitted an expression of interest for Go First, it subsequently backed out.

For the Go First lenders, the development comes at a time the Delhi High Court is hearing various petitions filed by lessors seeking the deregistration of their planes by the DGCA so that they could take them back.

The court had reportedly restrained Go First from removing, replacing or taking out any part or components.

The counsel for the RP had told the court that returning aircraft to the lessors will hit the airline hard and render it “dead”.