Calcutta: The Supreme Court will hear a petition of ArcelorMittal on Wednesday, challenging an appellate tribunal's order holding the company an ineligible resolution applicant under the Insolvency & Bankruptcy Code (IBC), 2016.

The hearing will take place a day after the deadline set by the National Company Law Appellate Tribunal to submit the overdue amounts for Uttam Galva and KSS Petron ended. ArcelorMittal is yet to make the payment.

On Tuesday, ArcelorMittal mentioned the matter before a Supreme Court bench comprising Chief Justice Dipak Misra and justices A. M. Khanwilkar and D.Y. Chandrachud who decided to hear the matter on Wednesday.

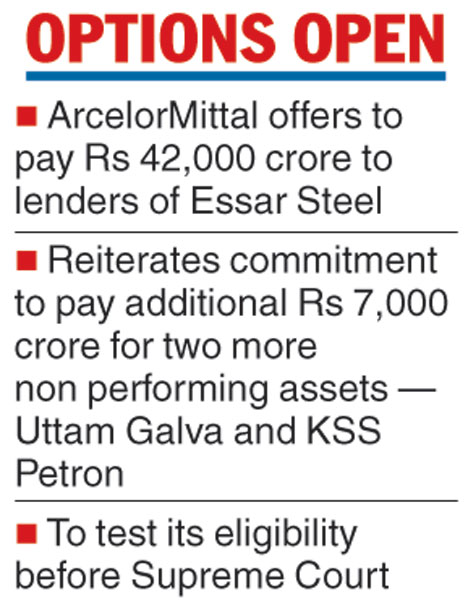

While the company said it was committed to paying the overdue amounts, it also decided to challenge the ineligibility issue before the highest legal forum in India.

According to the order of the NCLAT on Friday, the two bids submitted by ArcelorMittal will only be considered when the company makes the payment for Uttam Galva and KSS. Going by it, the bids made by the world's largest steelmaker could not be considered by Essar's resolution professional Satish Gupta and the committee of creditors (CoC) of Essar.

Banking sources said the lenders would not rush to take a decision on ArcelorMittal's bids till the apex court gives direction on the matter. In other words, the company would remain in the hunt for Essar.

The soft approach by the lenders could also be explained by a renewed offer made by the Lakshmi Niwas Mittal-promoted company on Monday, maximising the value for lenders and meeting the key objective of the IBC.

ArcelorMittal raised its offer for Essar by 20 per cent over its second bid to Rs 42,000 crore and agreed to clear the combined dues of at least Rs 7,000 crore for Utam Galva and KSS. However, it asked the CoC to provide the exact amount payable and the modalities of the payment.

The dual strategy - committing to pay and yet litigating further - drew a sharp response from the camp close to Numetal, the Russian firm-led consortium which is also competing for Essar.

"The NCLAT provided a lifeline to ArcelorMittal by giving it a three-day window to pay while the company should have paid the amount before submitting any bid," a source linked to the Numetal camp said.

Under Section 29A of the IBC, a resolution applicant is disqualified if it was tied to a loan account, which is non-performing for more than a year.

ArcelorMittal never accepted that it was a promoter of Uttam Galva and KSS. However, to clear any air on its seriousness to pay and the commitment made to lenders on Monday, the company made a regulatory filing before the international stock exchanges where it is listed.