Mumbai: The Reserve Bank of India (RBI) has reiterated its concern over the use of cryptocurrencies, such as bitcoins, despite barring entities regulated by it from dealing with or providing services to others who are transacting in such units.

At the same time, the central bank is evaluating the possibility of introducing a digital currency for which it has constituted an inter-departmental group.

In April this year, the banking regulator had blocked the use of banking channels for investors of these units, saying entities regulated by it cannot deal with such currencies. The RBI had then said that these virtual currencies raise concerns of consumer protection, market integrity and money laundering.

In February, Union finance minister Arun Jaitley had said cryptocurrencies are not legal. Since then, top banks had stopped supporting these transactions.

However, despite the steps taken, the central bank remains worried.

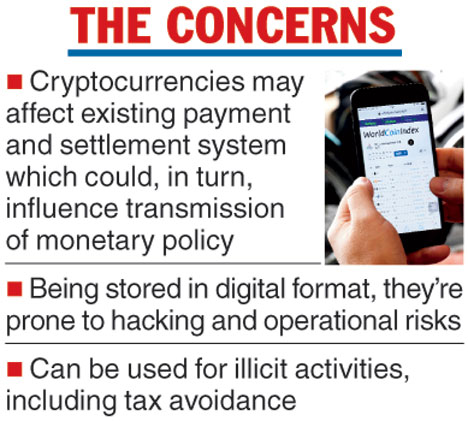

"Though cryptocurrency may not currently pose systemic risks, its increasing popularity leading to price bubbles raises serious concerns for consumer and investor protection, and market integrity. The cryptocurrency ecosystem may affect the existing payment and settlement system which could, in turn, influence the transmission of monetary policy. Further, being stored in the digital/electronic media - electronic wallets - it is prone to hacking and operational risks, a few instances of which have been observed globally," the RBI said in its annual report for 2017-18.

The RBI added that there was no established framework for the recourse to customer problems or dispute resolution as payments by these currencies take place on a peer-to-peer basis without an authorised central agency which regulates such payments.

"There exists a high possibility of its use for illicit activities, including tax avoidance. The developments on this front need to be monitored as some trading may shift from exchanges to peer-to-peer mode, which may also involve increased usage of cash," it noted.