|

Calcuttans dreading a property-tax bill from the blue showing a hefty amount in unpaid dues from years ago, relax.

Starting April, all bills will be up to date on paper as well as on the Calcutta Municipal Corporation (CMC) website, eliminating the possibility of taxpayers being saddled with a demand for unpaid dues one not-so-fine day.

Not only that, receipts for tax payments are downloadable from the website and will be treated as proof of no dues remaining pending from the previous year.

“If a property owner misplaces the receipt issued at the treasury counter while paying the dues, no need to worry. He or she can download a copy of it from www.kmcgov.in and that will be enough to challenge any addition to the next bill,” an official said.

The advantage of the system is that once dues are cleared, the civic revenue department cannot demand payment of dues up to that year at a future date by citing lack of updated payment records.

Say, a flat owner receives a bill for four quarters of the year 2012-13 with the column for unpaid dues showing an outstanding amount for four quarters of the year 2002-03.

Once he pays that amount, the CMC cannot claim from him extra dues for up to March 31, 2013, under any circumstance.

Tax bills issued earlier were seldom up to date, leaving even property owners who had paid their taxes regularly saddled with demand notices for unpaid arrears running into thousands of rupees. Those who hadn’t preserved their payment receipts needed to pay up whatever was demanded even if the claim was false.

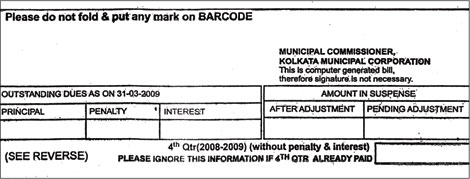

In the new system, house tax bills issued in April would have additional columns below the current demand schedule, where it will be mentioned whether there is any “outstanding dues as on 31.3.2013”.

The bill will also give the break-up of dues in terms of principal, penalty and interest charged on the principal. At the bottom of every such bill will be the message: “Please ignore this information if the amount has already been paid.”

Metro had recently highlighted the plight of taxpayers forced to pay old bills twice because they hadn’t preserved the payment receipts.

Brave were those who disputed the bills mentioning hefty pending dues. As most of them would testify, obtaining a no-outstanding certificate was next to impossible without making multiple trips to the civic body headquarters and oiling the hub and spoke of the billing machinery.

“It used to take two to three months and up to five visits to the revenue officers to obtain a certificate. A bribe of Rs 1,000 to Rs 2,000 would help speed up the process a little,” said a south Calcutta resident.

Civic officials said there was no possibility of taxpayers being harassed from now on.

“If you pay any amount, it will be automatically updated in the system. A downloaded copy of the current tax receipt will be your NOC,” confirmed mayoral council member (revenue) Debabrata Majumdar.

Up-to-date bills will also help property buyers be sure they are buying assets without tax liabilities.