|

If you had adulthood thrust upon you before the nineties, you wouldn’t have been a stranger to economic crises, though you’d have been unlettered in McDonald’s. Or Levi’s. In 1991, India stood on the verge of bankruptcy. Parents would still be telling tales of scarcity and rationing that dominated lives in the seventies and sixties and earlier to teach the morals of thrift.

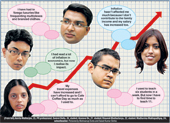

Since the nineties, it’s been a different India — of Big Macs and topped-up pizzas and cappuccino and mocha; of multiplexes and multiplying incomes. The party isn’t really over but of late a step or two haven’t been landing quite right. The bang for the buck isn’t quite there. There’s talk of inflation in the air. And the gas is costing more — and all bandhs have broken loose.

Are the good times over?

Daddy, daddy cool

Arunava De, a 21-year-old student from Bagbazar, gets an allowance of about Rs 800 every month. That’s small bean when De’s favourite cups at Cafe Coffee Day have got dearer by 8-10 per cent in the past few months.

“I need caffeine in my system to be at my best. Earlier, Rs 400 took care of my cafe bills for a month. Now I need more. Inflation has hit everything around us.”

Yes, inflation is now part of the wordstock, though it may not have graduated to SMS lingo yet. But the day isn’t far when you’ll read: “Can’t afrd S&C (Sex and the City, for the ignorant), ht by infl.”

“I have had to forgo luxuries like frequenting multiplexes and branded clothes or accessories. With a rise in roadside food prices, my daily expenses have risen, since I eat out a lot,” says Arunava.

Papa’s been kind. Arunava has had his pocket money upped by Rs 400, which should meet his modest need of caffeine. Lucky you!

Lohita’s lucky, too. A second-year mass communication student of St Xavier’s College, she now gets from her parents Rs 2,000, or Rs 500 more. And this time she did not have to plead very hard, or long.

“My parents were aware that things had become more expensive.” She read about the creature inflation in her economics (it’s her pass subject) textbook months ago — and suddenly it’s a bitter reality.

In one year, her favourite coffee, Barista Frappe, costs Rs 3 more, her haircuts at Sunflower in Southern Avenue are dearer by Rs 100, even the stole she bought for Rs 60 a few months ago from New Market does not come for anything less than Rs 100 today.

“I am reading about inflation in class and feeling it outside,” says Lohita Phooken.

This daddy cooler

Guys, you’d wish all of you could be like this well-paid executive at a multinational bank. Kalyan Basu, 25, earns 20k a month. Wait, the news just gets better. Papa picks up most of his bills.

“Things of daily use have not become significantly dearer. Maybe it does not affect me too much since I don’t have to shoulder a family’s responsibility yet,” says a burdenless Basu.

But he knows the budget worries of some of those around him. For him the worry is to keep running with the rising prices. “That’s something I need to do to maintain a decent living standard.”

Attaboy.

It’s the petrol, silly

Software professional Prasanna Singh earns his own keep and has had to make several compromises. “Two years back it took Rs 70 to go from my house in Santoshpur to my office in Sector V in a taxi. Now I pay nothing less than Rs 120. I have even stopped taking my car because petrol has become so expensive. I now take buses and autos,” said Prasanna.

That, friends, was before the latest price increase.

So what has he sacrificed? Magazines and CDs. It’s back to basics — food and travel.

“Earlier a meal for two at most of the restaurants in Park Street would cost about Rs 600. Now it comes to nothing less than Rs 1,000.”

For people like Singh, the recent downsizing and accompanying low increments — 3 to 5 per cent down on an average — in the IT industry make the pinch harder.

Inflation, textbooks will tell you, is highly unequal. Just as it doesn’t mean prices of most things would go up — or would go up to the same extent, it also doesn’t mean wages will rise evenly across industries to keep pace with inflation.

Many will be hurt, and some will be hurt more. Some will even benefit from inflation because they’re selling stuff whose prices have shot up the most.

Rishi Sinha (name changed), a call centre employee, is among the hurt. “No more regular hanging out at the Super Bowl (the bowling alley next to Nicco Park) for me. I haven’t got enough of a raise. So either I have to do away with this or my regular weekends at Park Street. I cannot afford both.”

Tough choice.

Or, the roll

Twenty-two-year-old Shaunak Bhattacharya, a student, is hurting bad. “Steadily rising prices spell disaster,” says Shaunak who comes from a middle-class family in north Calcutta and makes ends meet with what he earns from giving tuition.

“I used to teach six students in a week. But now I have to find time to teach 11.” A film buff and a foodie, he has had to leash his multiplex urges and roll pangs. His favourite egg-mutton number from roadside eateries along Park Street now cost him Rs 24, up from Rs18.

“I never thought inflation could eat into my daily life.”

If it’s rolls Shaunak is scrimping on, Pratijyoti Ghosh, 22, is burning a big hole in his pocket every time he buys his brand of cigarettes, which costs Rs 24 a packet instead of Rs 19 till recently. Even a 500ml cold drink bottle has become costlier by Rs 2 in the past six months or so.

Papa preaches thrift

Inflation, even moderate inflation, shakes the foundations of a country’s social structure, wrote an economist. Millions who “see themselves deprived of security and well-being become desperate. They tend to fall easy prey to adventurers aiming at dictatorship, and to charlatans offering patent-medicine solutions. The sight of some people profiteering while the rest suffer infuriates them. The effect of such an experience is especially strong among the youth. They learn to live in the present and scorn those who try to teach them ‘old-fashioned’ morality and thrift,” wrote Ludwig von Mises.

“Parents take care of all of their major expenses. Take my son’s example — he claims he is unable to make do with a sum that was beyond imagination when we were his age. The only reason behind their asking for more and more is the western consumerist culture that is steadily creeping into our future generations,” says Samrat’s father Sumit Dutta.

Samrat, 24, a student, says: “I had read a lot about inflation during my study of economics, but now I realise its impact.”

His father is generous, handing him an allowance of around Rs 2,000 every month. Still, “I have cut down on my biking due to the rise in fuel prices. I visit cafes less frequently. I hardly watch films in multiplexes any more.”

Thrift, self-taught

Some are putting off buying things that had seemed impossible to do without till interest rates started climbing. That’s one of the evil things the inflation monster does. It forces the country’s central bank, the Reserve Bank in our case, to raise interest rates.

Nayanika Banerjee, a 29-year-old media professional, is one of them. “I have been planning to buy a laptop. Though laptop prices have dropped, my daily expenses have gone up and I can’t afford to pay an EMI. So I have postponed it indefinitely.”

Now, you’re talking pre-’91. Welcome to the past, dudes and dahlings.

Price rise, what pricee rise?

At cinemas

Most popular shows: Morning shows, for their cheap tickets; evening shows on Fridays, weekend starts

Trendspotting: Ticket prices (at INOX) have gone up by 8 to 10 per cent in the past year. But the good thing is that we have flexi pricing, so the hike may be for just prime-time shows. The 18-30 age group forms 45-50 per cent of the footfall — Vikas Syal, regional general manager,INOX.

At Department stores

Top three items: Garments, cosmetics, watches

Trendspotting: If prices have risen, so has the spending power. The youth are earning well, and earning at a young age. The two biggest groups of buyers (at Shoppers Stop) are college students and the young executive, and the average shopper spends Rs 2,000-2,500 per visit — Naveen Misra, zonal head, Shoppers Stop.

At Nightclubs

Shisha

Top three: Shooters, hookah, pitta sandwiches

Trendspotting: When Shisha opened, our cover charge was Rs 500 for a couple. A little more than a year back, it was increased to Rs 1,000. That has not affected the crowd, footfall is increasing steadily at 15-20 per cent. Young working professionals form the biggest chunk of visitors and spend the most — Sovan Mukherjee, F&B manager, Shisha.

Venom

Top three: Foster’s beer; Black Label whisky; Venom Potion, a cocktail

Trendspotting: Of course the recent price hike will have an impact. We too are planning certain changes in prices, but it will take some time to be formalised. The nightclub opened in 2006 with a cover charge of Rs 500 for a couple, but after 6-8 months, it was raised to Rs 1,000 to control the crowd on Saturdays — Bunty Sethi, Venom.

At Coffee shops

Cafe Coffee Day

Top three: Cappuccino, Frappe, Sandwiches

Trendspotting: Prices have gone up by 10 per cent in the past 2-3 years. But footfall is increasing by 20 per cent. The average footfall on weekdays is 450, going up to 650 on a weekend. Seventy per cent of this consists of the youth — a source in Cafe Coffee Day.

Idiot’s guide to inflation

What is inflation?

Inflation occurs when the general level of prices is rising.

How is it calculated?

By using indices that take into account the prices of a wide variety of individual products and services. In India, the widely accepted index is the wholesale price index. The movement in the index is the measure of inflation.

What are the types of inflation?

Two: demand-pull and cost-push.

Demand-pull inflation occurs when demand exceeds supply. That is happening to us in India now with demand for food, particularly, racing ahead of supply.

Cost-push inflation takes place when, for example, there are shock increases in the prices of oil and food, which too are happening now.

We possibly have a combination of the two.

When will this end?

Inflation has been with us since the 13th century, so don’t expect it to end. Prices can only rise over the long term but sharp bursts, as now in India, are the worrying kind. Oil prices are expected to continue to rise but food — and other — supplies can be increased. There are also other weapons in the government’s hands to fight inflation. At this point of time, there’s no telling when the gallop will end.