|

Fast-changing trends in the financial markets and confusing trade jargon may have kept Pradip Kumar Ghosh away from the bourses but daughter Ipsita, 17, knows the difference between a bull run and a bear spell.

Ipsita, a student of South Point High School, has been certified “financially literate” — a term coined by the Securities and Exchange Board of India (Sebi) as part of a nationwide campaign to spread “savings, budgeting, money management and investment skills” among teens and twenty-somethings.

“I attended a three-month course on financial literacy and it demystified many things. I went back home and told my father how share prices rise during a bull run and decline in a bear spell. He was so impressed,” Ipsita, who wants to be a chartered accountant or a lawyer, told Metro.

“Yes, I was surprised when she told me the difference,” nodded father Ghosh.

Around 115 students had logged in for the three-month module developed by Sebi for students between Classes VIII and XII. A similar course was offered by MP Birla Foundation Higher Secondary School, where over 60 students attended classes twice a week for a fee of Rs 100.

In both the schools, teachers trained by the National Institute of Securities Markets — a public trust established by Sebi — taught students the basics of equities markets, mutual funds, banking and various other investment tools.

“Terms like sensex, net asset value, bull run, bear spell and mutual funds have become part of everyday conversation. I am happy to have learnt the meaning of some of them,” said Mudit Modi, a Class XII student of South Point.

With parents backing the move and students showing interest, several city schools that have been approached by Sebi are planning to include the course in their curriculum. Both the Apeejay schools will start offering the course from October.

“Financial markets have opened up and there are so many modes of savings and investments. Students learn physics, chemistry and math, but have no understanding of economic realities. Our courses are meant to enable students to take informed financial decisions,” said a senior Sebi official.

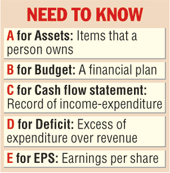

The training module includes exposure to real-life situations ranging from how to open a savings account and write a cheque to how to apply for loans and open a Demat (dematerialised) account. “The course material explains the financial terms in a lucid manner,” said Apeejay principal Reeta Chatterjee.

After the classroom sessions are over, students are tested on theoretical and practical understanding and awarded certificates of participation, appreciation and honour on the basis of their performance.

Lakshmipat Singhania Academy has invited officials of ICICI Bank to teach students about money and markets. “They will talk to students of classes V to X about loans, types of accounts and investment options. We will organise a workshop for classes XI and XII in November,” said principal Meena Kak.