Dumb tech

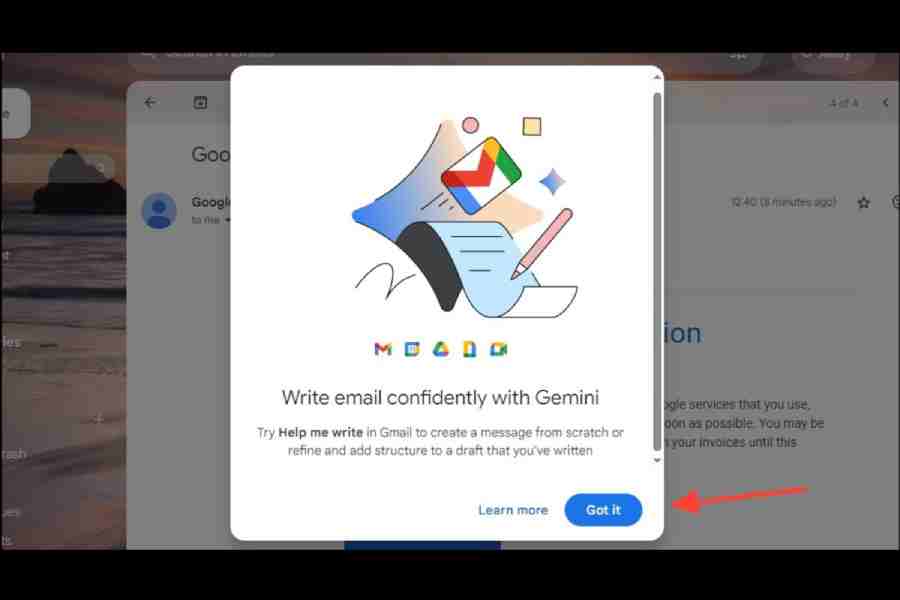

Sir — If one needed further proof of Artificial Intelligence’s lack of intelligence, one need only look at Gmail’s latest AI assistant, Gemini. An unavoidable addition to some Gmail accounts, Gemini offers to help write responses to emails, summarise emails and so on. Besides ridiculous summaries that miss vital points and anodyne suggestions for replies, this assistant also takes it upon itself to ‘helpfully’ suggest that the user check his or her tone. To the AI assistant, framing a reply with the words, ‘could’ or ‘please’, makes the sender seem less confident. In spite of all the data fed to AI, basic politeness clearly eludes it.

Raina Saha, Calcutta

Some relief

Sir — The Union budget has not strayed from the safe path and the markets reflect this inertia (“A balancing act”, Jan 2). The erstwhile reliance on capital investment-led growth for an economic recovery seems to have come to a premature end. The propulsion of the economy has been left to consumption, which the government plans to boost by increasing tax rebates. However, expanding the outlay for infrastructure in this budget could have fuelled substantial growth.

R. Narayanan, Navi Mumbai

Sir — The Union finance minister claims to have helped the middle class by making income up to Rs 12 lakh tax free. But where are the jobs that pay employees Rs 12 lakh? Where is the roadmap for the two crore jobs that were promised annually? Any money earned these days is eaten up by inflation, the rest goes in goods and services tax and sundry other cesses.

Asim Boral, Calcutta

Sir — The Union finance minister should be lauded for presenting a budget that favours the salaried middle class. It would be better if she had waived off the GST on insurance, especially medical insurance.

N. Mahadevan, Chennai

Sir — Farmers’s woes were addressed in the budget but the focus was on 100 districts with low productivity, moderate crop intensity and below-average credit parameters. This scheme, the Prime Minister Dhan-Dhaanya Krishi Yojana is supposed to help 1.7 crore farmers. But is this enough?

Akhilesh Krishnan, Navi Mumbai

Sir — The 2025-26 Union budget will propel India towards becoming a global superpower. Tax relief for the middle class, the Prime Minister Dhan-Dhaanya Krishi Yojana and Mission for Aatmanirbharta in Pulses will boost employment and development in villages. A Rs 20 crore loan guarantee for start-ups and micro, small and medium enterprises will boost employment and tax exemptions on some life-saving medicines and 10,000 new medical seats will ensure accessible healthcare. This budget is a historic step toward ‘Viksit Bharat’.

R.K. Jain, Barwani, Madhya Pradesh

Sir — During the budget speech, the Sensex fell by 759 points and Nifty dropped by 60 points. The finance minister was, unsurprisingly, kind to Bihar, while starving schemes like the Mahatma Gandhi National Rural Employment Guarantee Act. This budget lacks a plan to control inflation and to create jobs. It will not eradicate India’s problems.

Furthermore, by abolishing a separate budget for the railways, a veil has been drawn over what investments are being made in that sector. This eases the way for the government to hand over the railways to crony capitalists through public-private partnerships.

Bishwanath Yadav, West Burdwan

Sir — The budget deserves praise for income tax rebates, especially at a time when the economy has slowed down with insipid household consumption. By raising the limit of income tax rebate from Rs 7 lakh to Rs 12 lakh, the Centre aims to boost middle-class income and drive long-term, sustainable growth. The raising of the limit on foreign direct investment in the insurance sector will deepen the bond and equity markets. The budget has understood the need to put more money in the hands of the middle class.

M. Jeyaram, Sholavandan, Tamil Nadu

Sir — The new taxation policy with substantial tax breaks is a politically astute decision. But can the government sustain this fiscal generosity without derailing its broader financial discipline? The government has sought to reduce the tax burden while keeping the fiscal deficit in check. This is a tight-rope walk. High food inflation remains a major concern. The estimated revenue loss from tax cuts will be to the tune of Rs 1 lakh crore, and while the government has increased capital expenditure to Rs 11.21 lakh crore, room for further spending is limited.

S.S. Paul, Nadia

Sir —The latest income tax rejig reveals the Centre’s effort to avert the slump in the economy. It is an out-of-the-box budget.

Ashok Jayaram, Bengaluru

Sir — The Union budget primarily aims to please the saffron camp’s vote bank, the middle class. It is lopsided.

Murtaza Ahmad, Calcutta