A writeback of Rs 52,637 crore from the “rainy day” fund in the Reserve Bank of India’s balance sheet to its income statement.

- An accounting tweak to reassess the gain from its foreign exchange transactions.

- A sharp increase in interest income from its bond operations.

- An accretion of 51.93 tonnes to the stock of gold it holds abroad.

All these have contributed to the Rs 175,991-crore surplus the RBI earned in 2018-19 that it has turned over to the Centre’s parlous treasury.

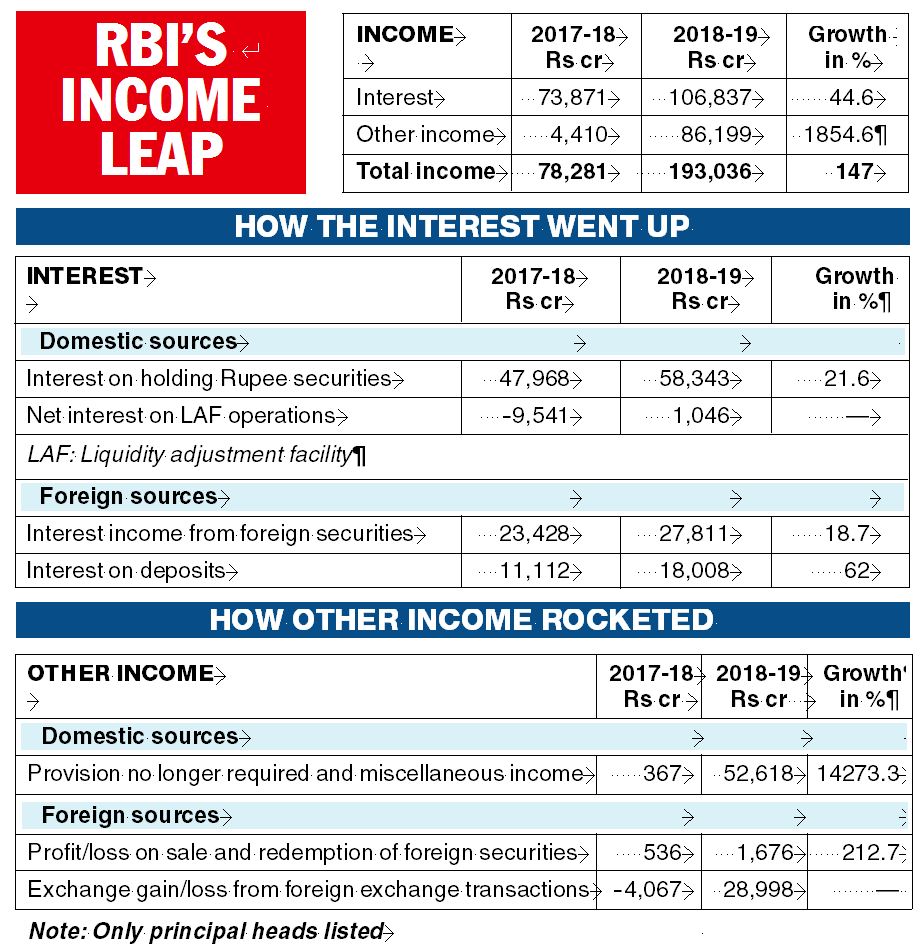

The total income of the RBI leapt to a five-year high of Rs 193,036 crore as compared with Rs 78,281 crore in the previous year — a rise of nearly 147 per cent.

In its annual report released on Thursday, the central bank realised a surprise gain of Rs 28,998 crore on its foreign exchange transactions after changing its accounting methodology for the first time.

The RBI — acting on suggestions made earlier by the Malegam committee in 2013 and the Jalan panel report submitted last Friday — decided to value its foreign exchange transactions (principally buying and selling of dollars) on the basis of a long-period weighted average cost method.

Earlier, it used to mark to market these transactions every week. The resultant gains — or losses —were sliver thin because of the narrow difference between the sale price and its weekly rate.

The result of the new method: the central bank was able to show a huge gain against a loss of Rs 4,067 crore in 2017-18 and an even higher Rs 5,116 crore loss in 2016-17.

It had made a profit under this head of Rs 3,836 crore in 2015-16 — when it first started to come out with an extensive break-up of the components of its “other income”.

Ananth Narayan, professor at the SPJIMR business school, told The Telegraph that the change in accounting policy was justified.

“The past accounting policy was incorrect and it is being corrected now. The RBI is doing something like an inventory valuation of the currency reserves. It is in line with standard accounting practice. As it is being corrected now, we are getting a big one-time impact,” he said.

For some reason that wasn’t immediately clear, the transfer from the rainy day fund in its accounts reflects a figure of Rs 52,618 crore in the break-up of “other income” rather than the figure of Rs 52,637 crore it reported after the central board of directors met on Monday and accepted the Jalan panel report and approved the accounts for the year ended June 30.

One explanation is that the discrepancy of Rs 19 crore might have been drained by a negative balance in miscellaneous income but this is not explicitly stated.

The central bank’s interest income was also bolstered by domestic operations as it purchased government securities from banks during the year (July-June) to pump up liquidity. As a result, the RBI earned higher coupon income from its holding of these government securities.

During the year, it made net purchase of government securities amounting to Rs 331,112 crore. The RBI’s annual report showed that interest income generated from holding such rupee securities rose to Rs 58,343 crore from Rs 47,968 crore in the preceding year.

As a consequence, its interest income from domestic sources (which also includes other heads like interest on loans and advances) rose from Rs 39,331 crore in 2017-18 to Rs 61,022 crore in 2018-19.

The central board of the RBI had on Monday decided to accept the recommendation of the Jalan panel and had added an excess provision of Rs 52,637 crore from its contingency fund to its income.

The rainy day savings — represented by the contingency fund which is meant to deal with unforeseen crisis situations — shrank to Rs 196,344 crore from Rs 232,108 crore last year.

Provisions transferred from the income statement to the balance sheet were negligible at Rs 64 crore — and meant only for the asset development fund which uses it for investments in subsidiaries and associated institutions and to meet internal capital expenditure.

Last year, a sum of Rs 14,190 crore had been transferred as provisions to the contingency fund.

Although the RBI currently follows a July-June year, the Jalan committee has recommended that the apex bank’s accounting year be brought in line with the April-March fiscal year.

During the year, the RBI’s balance sheet increased by 13.42 per cent from Rs 36,17,594 crore as on June 30, 2018 to Rs 41,02,905 crore as on June 30, 2019.

On the asset side, domestic assets constituted 28.03 per cent while the foreign currency assets and gold (including gold held in India) accounted for 71.97 per cent of total assets as against 23.18 per cent and 76.82 per cent, respectively, in the previous year.

The RBI’s annual report showed that the value of gold coins and bullion increased to Rs 88,298 crore from Rs 69,674 crore.

Gold, including the gold deposits placed abroad, is revalued on the last business day of the month at 90 per cent of the average of the gold price, quoted daily by the London Bullion Market Association for the month. (See Business)

The Telegraph