The average tax paid by corporate taxpayers has increased from Rs 32.28 lakh in AY 2014-15 to Rs 49.95 lakh in AY 2017-18 (a rise of 54 per cent).

There is also an increase of 26 per cent in the average tax paid by individual taxpayers from Rs 46,377 in AY 2014-15 to Rs 58,576 in AY 2017-18.

During the period under reference, the number of salaried taxpayers increased from 1.7 crore for AY 2014-15 to 2.33 crore for AY 2017-18 (up by 37 per cent). The average income declared by the salaried taxpayers went up by 19 per cent from Rs 5.76 lakh to Rs 6.84 lakh.

During the same period, there was a growth of 19 per cent in the number of non-salaried individual taxpayers, from 1.95 crore to 2.33 crore.

The average non-salary income declared increased by 27 per cent from Rs 4.11 lakh in AY 2014-15 to Rs 5.23 lakh in AY 2017-18.

CBDT chairman Sushil Chandra said these numbers were a result of several legislative, informative and enforcement efforts by the tax department over the past few years.

Indruj Rai, associate partner of Khaitan & Co, said: “It has been a carrot-and-stick approach. There have been several measures taken by the government to counter tax avoidance and evasion in the recent years. A higher rate of tax (60 per cent) was prescribed for unexplained cash credits, investments and expenditure, post demonetisation. There has also been a surge in the number of prosecution cases initiated by the tax department, which would naturally act as a deterrent to tax evasion.”

For AY 2014-15, the return filers had declared gross total income of Rs 26.92 lakh crore, which has increased by 67 per cent to Rs 44.88 lakh crore for AY 2017-18, the CBDT said.

The data also added that a growth of more than 80 per cent was registered in the number of returns filed in the last four financial years -- from 3.79 crore in 2013-14 to 6.85 crore in 2017-18.

The number of persons filing return of income has also increased by about 65 per cent during this period from 3.31 crore in FY 2013-14 to 5.44 crore in FY 2017-18. The data also showed that there has been a constant growth in direct tax-GDP ratio over last three years and the ratio of 5.98 per cent in FY 2017-18 is the best in the past 10 years.

The Telegraph

The country’s crorepati club is growing — and the Narendra Modi government has been quick to seize on that statistic to once again drum the virtues of its egg-in-the-face demonetisation exercise and the subsequent crackdown on tax dodgers.

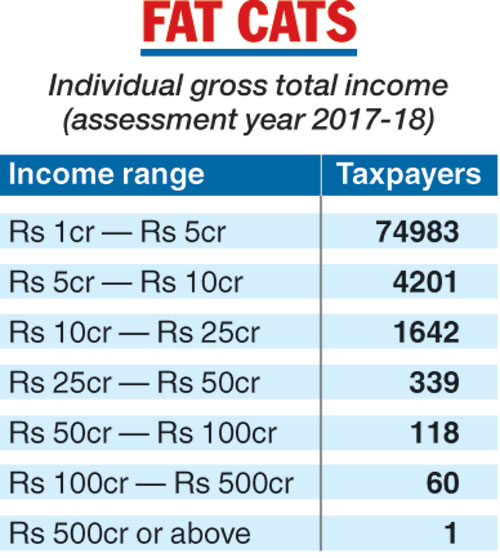

The government claimed that the drive forced 81,000 taxpayers to disclose incomes of over Rs 1 crore in the assessment year 2017-18. But the Congress read it as evidence of widening income disparity in the country.

The disclosure of big bucks by India’s 81,344 fat cats represents a 68 per cent increase over the 48,417 people who had volunteered such information in their tax filings related to the assessment year 2014-15. The Central Board of Direct Taxes’ choice of year is significant as it appears to be a way to belittle the achievements of the UPA.

There were 60 with incomes of more than Rs 100 crore but less than Rs 500 crore as against 17 in the assessment year 2014-15. But only one individual filed a tax return disclosing a gross total income of over Rs 500 crore, compared with seven earlier.

Officials said the latest statistics take into account a time period of three years as the assessment year 2014-15 had been chosen as the base year but did not explain why they had picked that year.

If the field is broadened by including corporate entities, partnership firms and Hindu undivided families, the crorepati club swells to 140,139, a 58 per cent increase over the figure of 88,650 in the assessment year 2014-15.

The increase in the number of high-income taxpayers has been ascribed to the carrot-and-stick policy adopted by the Modi government against traditional tax dodgers.

Besides, formalisation of the economy and increased tax compliance because of measures that include the demonetisation have helped, several economists and tax experts said.

Rakesh Nangia, managing partner of Nangia Advisors LLP, said: “The significant increase in the number of large taxpayers (with over Rs 1 crore income) is an indicator to reflect that the government’s efforts to broaden the tax base and bring transactions into the tax net is showing positive results. It also shows the reduction in extent of unreported cash economy.”

The Congress’s data analytics, however, interpreted the latest set of income statistics differently. It said the concentration of wealth in the hands of the top taxpayers had accentuated during Modi’s tenure.

“In 2013, the top 1 per cent of income-tax filers earned 15 per cent of all income. But by 2016, they earned 45 per cent of all income,” its study said.

N.R. Bhanumurthi of the National Institute of Public Finance said: “The data is a reflection of the increased tax buoyancy and the effect of the demonetisation. However, it would be interesting to see the 2018-19 data which is a normal year (unlike the previous two years when the demonetisation and the introduction of GST played a part in determining tax declarations).”