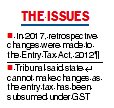

The West Bengal Taxation Tribunal has ruled the state legislature cannot make amendments to the entry tax act retrospectively after it was subsumed under the Goods and Services Tax (GST).

The ruling has given a breather to around 100 companies — including Tata Steel, Samsung India Electronics and Birla Tyres.

The tribunal said that applications filed by the petitioners are “allowed on contest but without any order as to costs”.

The Centre through the 101st Constitutional Amendment Act, 2016 had struck off entry 52 of list II of the 7th Schedule relating to the state government's powers to levy tax on goods entering the state.

The three-member tax tribunal chaired by Justice Malay Marut Banerjee, judicial member Suranjan Kundu and technical member Chanchalmal Bachhawat in its judgment last month held that after the omission of entry 52, there is no vestige of power left with the state legislature to legislate or amend the entry tax act.

A single-judge bench of Calcutta High Court earlier in 2013 declared entry tax as unconstitutional.

But the Supreme Court in the case of Jindal Stainless versus the State of Haryana had upheld the constitutional validity of the powers of the state to demand entry tax for allowing goods and raw materials into their territories.

The Bengal government through Finance Act 2017 brought about amendments to the West Bengal Tax on Entry of Goods into Local Areas Act 2012, whereby entry levies were deemed to be valid.

The amendments were challenged on the ground that the state has lost its legislative competence to amend the entry tax act.

The state government on the other hand argued that Section 19 of the Constitutional Amendment Act empowered the legislature to amend the act any time before the expiry of one year.

The state argued it had introduced the amendments through Finance Act 2017 prior to the expiry of one year.

“Having regard to the deletion of entry 52 of the state list and bearing in mind the provision contained in section 265 of the Constitution, we are impelled to hold that the state legislature did not have the legislative competence to bring in such amendment insofar as it related to the West Bengal Tax on Entry of Goods into Local Areas Act, 2012.,” the tribunal’s judgment said.

“We find and hold that section 5 and section 6 of the West Bengal Finance Act, 2017 are ultra-vires and unconstitutional,” the judgment said.

Implication

As per the 2018-19 budget documents, the state had estimated an entry tax collection of Rs 1550 crore net of refund in 2017-18 but there were no budget estimates on collection under Entry Tax Act since 2018-19. Tax practitioners and observers held the view that this judgement will have a direct impact on the existing cases which has been allowed for contest.

“The judgement of the taxation tribunal will have a direct bearing on the cases where challenge has been made to the Entry Tax Act and where proceedings are pending, in any manner. As the retrospective amendment has been struck down as being unconstitutional, the levy of entry tax ceases to be legal or valid. Taxpayers with pending proceedings will do well to adopt consequential steps in their own case," said Aditya Hans, partner Dhruva Advisors LLP.

“A conclusion is yet to be reached. If finally it is concluded that entry tax is not payable, then those who have not paid will not be required to pay anymore and those who have already paid, then they may claim refund. The government may also stop the refund by enacting another retrospective legislation to say that whatever is already paid is paid and cannot be refunded," said Arun Agarwal, chairman, Council on Indirect Tax and GST, MCCI.