Mumbai, Aug. 24: The stock market crash today may pose difficulties for initial public offers (IPOs) that are on a comeback course following three disappointing years.

Activity in the primary market has been picking up with close to six offerings raising over Rs 2,830 crore till July. Many others are in the pipeline, including some well-known names such as IndiGo, Cafe Coffee Day and Matrix Cellular.

However, analysts warn that the IPO market could suffer a major jolt if the current trend persists.

"The IPO market has a strong co-relation with the secondary markets. We have seen in the past that when secondary markets are not doing well, very few issues hit the market. When seen in this context, one needs to wait and watch over the next couple of weeks if there is a recovery. However, if the current development indicates a long-term trend, it will affect the IPO market," Pranav Haldea, managing director of PRIME Database, said.

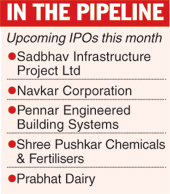

Five companies, including Sadbhav Infrastructure Project and Navkar Corp, are set to hit the capital markets this month to raise an estimated over Rs 1,500 crore.

While the IPO of Navkar opened for subscription today, that of Pennar Engineered Building Systems and Shree Pushkar Chemicals and Fertilisers will begin on August 25 and close on August 27. This will be followed by Prabhat Dairy, which will open on August 28, and Sadbhav, which will hit the markets on August 31.

These offers follow the strong response to Biocon arm Syngene International whose initial offering was subscribed 31 times.

Its shares listed at a premium of 18 per cent to the issue price of 250 apiece and the scrip now trades at Rs 314.10 on the BSE.