|

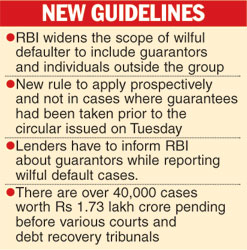

Mumbai, Sept. 9: The Reserve Bank of India today tightened norms pertaining to wilful defaulters by stating that if a non-group company failed to honour the guarantee furnished on behalf of the defaulting entity, it would also be treated as a wilful defaulter.

The announcement came in the form of a clarification in response to queries from various banks.

Recently, the United Bank of India had declared Kingfisher Airlines, its promoter Vijay Mallya and three other directors as wilful defaulters, citing alleged diversion of funds.

Wilful default covers various aspects that include deliberate non-payment of dues despite adequate cash flow and good net worth, siphoning off funds to the detriment of the defaulting unit, misrepresentation or falsification of records and fraudulent transactions by the borrowers.

Under the current rules, companies within the group considered wilful defaulters when they are unable to honour the guarantees furnished by them on behalf of the defaulting units.

The central bank is now extending this rule to cover guarantors and individuals outside the group.

“In connection with the guarantors, banks have raised queries regarding inclusion of names of guarantors who are either individuals (not being directors of the company) or non-group corporates in the list of wilful defaulters.

“When a default is made in making repayment by the principal debtor, the banker will be able to proceed against the guarantor/surety. In case the said guarantor refuses to comply with the demand made by the creditor/banker, despite having sufficient means to make payment of the dues, such guarantor would also be treated as a wilful defaulter,’’ the RBI said in a circular.

However, the RBI added that the new rule would apply only prospectively and not in those cases where guarantees had been taken prior to the circular.

SBI notice to Mallya

The State Bank of India today said it had sent a notice to Kingfisher Airlines promoter Vijay Mallya and three other directors to tag them as “wilful defaulters”.

“We have sent a notice to KFA (to declare it as wilful defaulter). There is a mandatory time that needs to be given to them to respond and that time is currently on,” said SBI chairperson Arundhati Bhattacharya.