The rupee on Tuesday hit more than a one-month high against the dollar buoyed by inflows from foreign portfolio investors (FPIs) and lower crude oil prices amid exporters offloading their positions.

At the inter-bank forex market, the domestic unit zoomed 72 paise to breach the 79-mark and even crossing 78.50 to hit 78.49 to the dollar.

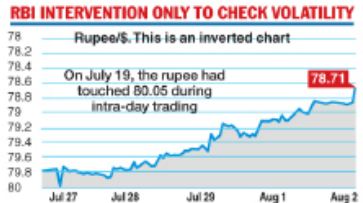

The rupee later settled at 78.71 — a gain of 21 paise over the previous close of 79.02 on dollar buying by PSU banks on behalf of oil companies.

Meanwhile, finance minister Nirmala Sitharaman informed the Rajya Sabha that the RBI is continuously monitoring the local currency and intervening only if there is volatility

“The RBI interventions are not so much to fix the value of the rupee because it is free to find its own course,” the minister told the Rajya Sabha.

It was also not a bad day on the stock markets: the benchmark indices overcame geopolitical concerns to close shop with marginal gains even as most of its Asian peers saw losses of up to 2.36 per cent.

The 30-share BSE benchmark ended 20.86 points, or 0.04 per cent, higher at 58136.36 after it fell 370 points to touch a low of 57744.70 because of worries over tensions between the US and China.The markets recovered following buying in select banking, oil and gas, power, FMCG and auto stocks, with the Sensex rebounding 583 points from the day’s low to touch 58328.41 towards the fag-end of the session.

At the NSE, the broader NSE Nifty finished at 17345.45, up 5.40 points or 0.03 per cent.

Bond prices also rallied with yields on the benchmark 10-year paper dropping to 7.19 per cent against the previous finish of 7.24 per cent.

Bond yields have been heading southwards since July 21 based on the surmise that the Fed will not resort to aggressive rate increases.

More recently, the drop in crude oil prices and lower commodity prices have generated optimism that the RBI may not increase the repo rate by 50 basis points this Friday and that it could settle for a relatively lower hike.

Forex circles said that the gains in the domestic currency on Tuesday came as dollar supplies improved on account of FPI buying in equities. Provisional data showed their net purchases at a strong Rs 2,321 crore.

They added that exporters who earlier held on to their positions expecting the rupee to touch 81 against the dollar liquidated their positions.

According to Dilip Parmar, research analyst, HDFC Securities, the rupee and domestic equities outperformed the region as foreign institutions turned into net buyers of equities and debt.

He said the dollar-long liquidation, FPI inflows, lower crude oil prices and improvement in high-frequency data supported the currency. Parmar does not rule out the possibility of the rupee appreciating to 77.60 if the present trend continues, though he cautioned that participants should adjust their position according to the news flow from US and China.

Realty concern

Days before the RBI monetary policy announcement, the real estate sector is worried that further hikes in interest rates by the central bank to tame inflation would slow down demand.

Shishir Baijal, chairman and managing director, Knight Frank India, said: “An upward revision will impact sentiments of home buyers, who have remained positive despite the last set of revisions that led to a rise in home loan interest rates. A further increase in repo rates will lead to a proportionate erosion of affordability, thereby impacting sales momentum.”

Anuj Puri, chairman Anarock Group, said: “If another repo rate hike takes place,home loan interest rates willenter the red zone, and we canexpect at least short-term repercussions on overall housing demand.

“Inflation is now one ofthe significant risks in real estate, and increased input costshave already compelled manydevelopers to hike propertyprices in the first half of 2022.”

With inputs from Delhi bureau