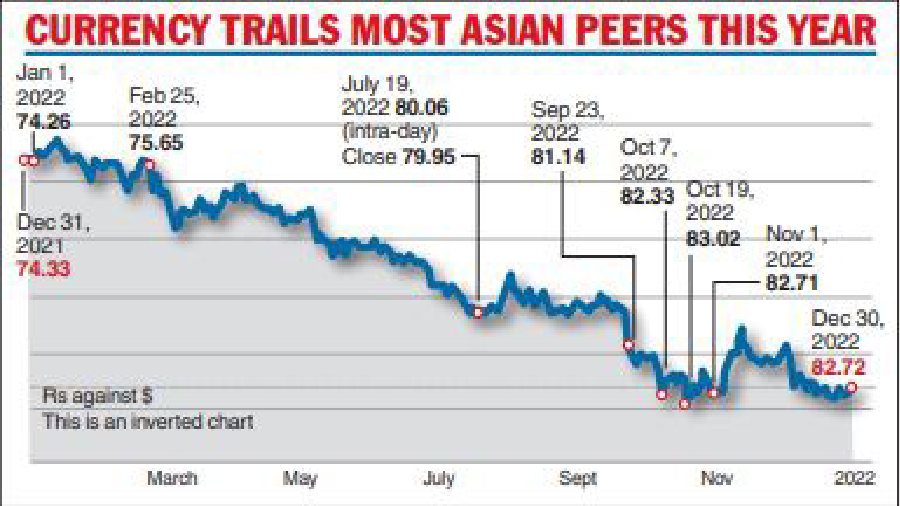

The rupee fell as much as 11.3 per cent against the dollar in 2022 — the worst-performing Asian currency this year and also its worst showing since 2013.

The Indian currency buckled under rising commodity prices because of the war in Ukraine, outflows from foreign portfolio investors (FPIs) and aggressive interest rate tightening by the US Federal Reserve.

It ended the last trading session of 2022 at 82.72, a gain of around nine paise over the previous close.

Analysts said there were reasons to be optimistic about the rupee in 2023. The currency could gain from moderation in commodity prices, higher portfolio inflows and a resilient economy amid some of the central banks going slow or pausing their monetary tightening.

“Historically, after a high volatile year, the rupee tends to see lower volatility next year. In 2022, monetary policy divergence between the US Fed and emerging market central banks was the source of high volatility,” Anindya Banerjee, vice-president at Kotak Securities, told The Telegraph.

“In 2023, monetary policy convergence and possibility of a rate cut during the fag end of the year from the Fed, will allow for lower volatility in the rupee. We expect a range of 79.50 and 85.50 on spot.’’

Since December last year, the domestic unit has lost 839 paise against the greenback. During the same period, the safe haven US dollar has climbed over 8 per cent as reflected by the dollar index which was then at 95.96. It is now trading at 103.81 after hitting a 52-week high of 114.48 on September 28.

The rupee opened at 82.77 on Friday and hit a high of 82.70. It closed at 82.72 against 82.81 on Thursday.