Shares of Reliance Industries Ltd (RIL) rose 5.72 per cent after months of underperformance, powering benchmark Sensex over the 80000 mark as better than expected results from its retail and telecom business whetted investors’ interest in India’s largest company by market capitalisation.

The RIL stock ended the day with ₹1,368.5 on the BSE, up ₹68.45 a share, after analysts upgraded the script.

Out of 32 analysts covering the stock, at least 13 hiked their price targets while a dozen upgraded their ratings, according to data compiled by LSEG and reported by Reuters.

“Stock valuation has turned attractive,” Antique Broking said in a note. “The telecom outlook is robust with strong subscriber growth and another round of tariff hike over the next 12-15 month.”

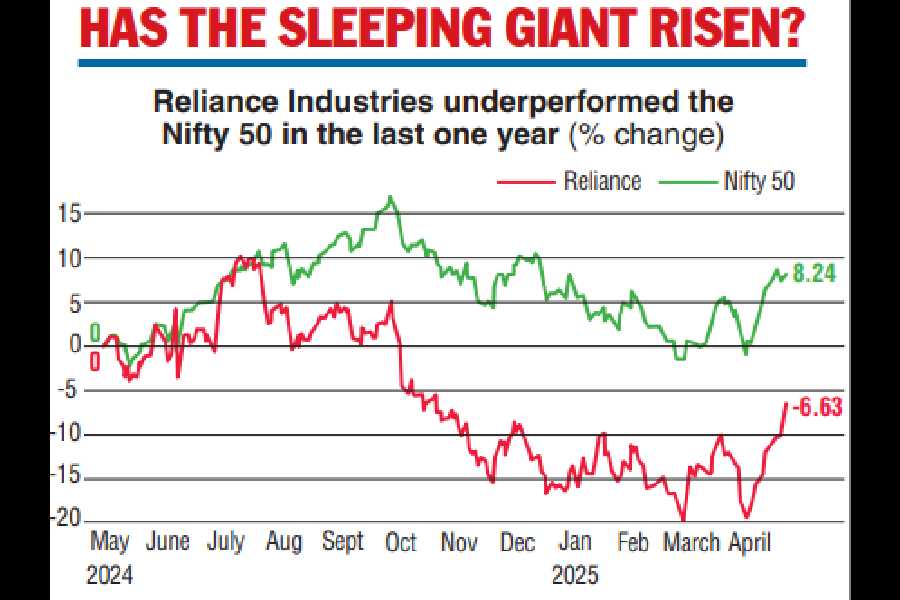

Over the last year, the Mukesh Ambani led behemoth had underperformed the benchmark Nifty 50 (see chart). However, the mood seems to be changing. Morgan Stanley sees management’s confidence in retail growth and ramp up in new energy business as key catalysts. Nomura listed RIL as the ‘top pick’ in the Indian energy sector.

While RIL was clearly the showstopper, the broader market was also supported by banks, metal and capital goods stocks.

The 30-share BSE Sensex jumped 1005.84 points, or 1.27 per cent, to settle at 80218.37 with 23 of its constituents ending with gains and seven in the red. During the day, it surged 1109.35 points, or 1.40 per cent, to 80321.88.

The NSE Nifty rallied 289.15 points, or 1.20 per cent, to close at 24328.50.

All key sectors, barring IT, participated in the rally, with pharma, energy, and auto emerging as the top gainers.

Foreign Institutional Investors (FIIs) bought equities worth ₹2,952.33 crore on Friday, according to exchange data.

Foreign investors have infused ₹17,425 crore in the country’s equity markets last week, supported by a combination of favourable global cues and strong domestic macroeconomic fundamentals.

This came following a net investment of ₹8,500 crore in the preceding holiday-truncated week ended April 18.

“The domestic market recouped the losses incurred during the last two days of the previous week, which stemmed from the border tensions.

“Sustained buying from FIIs and better results from RIL also boosted the investor sentiment. A weakening dollar and inflationary pressure in the US may attract FIIs into the domestic market,” Vinod Nair, head of research, Geojit Investments Limited, said.

“The absence of any major geopolitical developments between India and Pakistan over the weekend, along with stability in global markets, eased pressure and triggered an upbeat start. Additionally, strength in index heavyweight Reliance, following its results, further supported the move as the session progressed,” Ajit Mishra – SVP, Research, Religare Broking Ltd said.

In the Asian markets, South Korea’s Kospi index and Tokyo’s Nikkei 225 settled in the positive territory while Shanghai SSE Composite and Hong Kong’s Hang Seng ended lower.

European markets were trading higher. US markets ended with gains on Friday.

Global oil benchmark Brent crude dipped 0.19 per cent to $66.74 a barrel.