Calcutta, June 20: The finance ministry has laid the groundwork for public provident fund (PPF) subscribers to close their account prematurely.

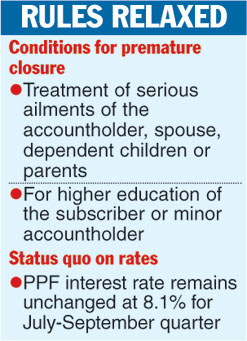

In a notification dated June 18, North Block has introduced an amendment to the Public Provident Fund Scheme 1968 allowing subscribers to prematurely close their accounts after the completion of five years on account of higher education or medical expenditure.

PPF has a tenure of 15 years. Till now, the scheme did not allow premature withdrawal except in case of deaths. Requests for premature closure and refund of deposits on grounds of genuine hardship were dealt with under Rule 13, which allowed the government to relax the provisions under the scheme.

"A subscriber shall be allowed premature closure of his account or the account of a minor of whom he is the guardian on the ground that the amount is required for treatment of serious ailments or life threatening diseases of the account holder, spouse, or dependent children or parents on production of supporting documents from competent medical authority," the finance ministry said.

It added that premature closure would also be allowed for accountholders in need of funds for higher education of the subscriber or minor accountholder following the production of documents and fee bills confirming admission in a recognised institution in India or abroad.

However, the subscriber will receive a lower interest rate in case of premature closure.

"Premature closure shall be subject to deduction equivalent to one per cent less interest on the interest rates applicable from time to time payable on deposits held in the account from the date of opening till the date of such premature closure," the notification said.

For PPF, the amount received on premature closure is exempt from tax. However, for Employees' Provident Fund, tax will be deducted at source on withdrawal before the completion of five years of service.

Rates unchanged

The finance ministry has kept the small savings rate unchanged for the July-September quarter of 2016-17.

The government had earlier decided to notify the interest rates on a quarterly basis. While savings deposit will continue to earn 4 per cent interest, the rates for five-year term deposit, recurring deposit, monthly income scheme and senior citizens savings scheme remain the same.<>

at 7.9 per cent, 7.4 per cent, 7.8 per cent and 8.6 per cent, respectively.

PPF interest rate remains unchanged at 8.1 per cent for the quarter.