The board of state-owned explorer ONGC would be meeting here on Saturday to finalise the second interim dividend to bail out the government, facing a revenue crunch, and help it to meet the revised fiscal deficit target of 3.4 per cent of GDP.

In a stock exchange filing, ONGC said the board would be meeting on March 23 to consider the interim dividend.

ONGC had initially resisted a government demand for a second interim dividend, stating it did not have the surplus money after announcing an interim dividend of Rs 5.25 per equity share on February 14 and approving a Rs 4,022-crore share buyback.

The PSU had argued that the existing regulations did not allow a company to declare a second dividend within a month of the previous payout and firms need to seek approval of market regulator Sebi to make such a payment.

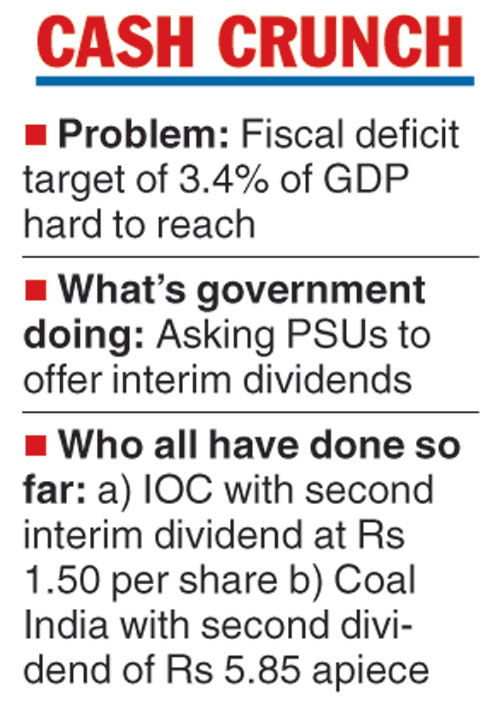

The government is likely to face a Rs 80,000-crore shortfall in direct and indirect tax revenues, which will make it difficult to meet a revised fiscal deficit target. The government has been tapping cash-rich PSUs for a second interim dividend.

Indian Oil Corp (IOC) has declared a second interim dividend of Rs 1,412 crore for the current financial year. It had stated in a stock exchange filing that its board had approved payment of Rs 1.50 per share, or 15 per cent, in second interim dividend for 2018-19.

Coal India Ltd on March 14 declared a second interim dividend of Rs 5.85 per share.

The Telegraph

The government is struggling to meet the revised fiscal deficit target in view of the shortfall in GST collections.

While presenting the interim budget for 2019-20, the government had revised upwards its fiscal deficit target to 3.4 per cent of the gross domestic product (GDP) for the current financial year from the previously estimated 3.3 per cent of GDP.

Economic affairs secretary S.C. Garg has said that as per “our assessment, in direct taxes, we will probably do as per the revised estimate. In indirect taxes, there might be some shortfall, and on the expenditure side there might be some savings”.

The GST shortfall is likely to be around Rs 30,000-40,000 crore and a similar shortfall is expected in direct tax collections as well, sources said.

In the current fiscal, direct tax collection is pegged at Rs 12 lakh crore (revised estimate). The government had originally budgeted to collect Rs 11.50 lakh crore in 2018-19 from direct taxes, which include corporate tax and personal income tax.

“The revised direct tax revenue target of 19.8 per cent was overambitious. The growth rate in the direct tax revenues is likely to be around 14 per cent. This looks reasonable given that the nominal GDP growth rate for the current year may be around 11 per cent plus, implying tax buoyancy of 1.2 per cent,” said D. K. Srivastava, chief policy advisor, EY.