New Delhi, Oct. 27: State-owned Oil and Natural Gas Corporation (ONGC) has reported a 6.2 per cent increase in net profit at Rs 4,974.92 crore for the second quarter ended September and announced a bonus share to increase liquidity ahead of its divestment.

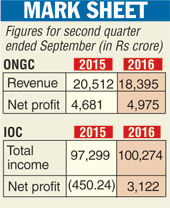

Net profit stood at Rs 4,681.39 crore in the year-ago period, the company said.

Lower crude oil and natural gas price pulled ONGC's gross revenue down 10.3 per cent to Rs 18,395 crore from Rs 20,512 crore a year ago.

Price realisation stood at $47.92 per barrel of crude, 4 per cent higher than that the first quarter, from self-operated blocks. In joint venture blocks, the price realisation rose 7 per cent to $41.71 per barrel.

ONGC did not have to bear any subsidy burden in the second quarter. Price realisation on gas, sold at $3.06 per million British thermal units, remained stable on a sequential basis.

Bonus cheer

ONGC said its board had approved the issue of bonus shares in the proportion of one new share for every two existing ones of Rs 5 each.

The company, which has about Rs 14,000 crore cash committed in future projects and capex, favoured issuing bonus shares rather than dividends as a method of providing income to shareholders.

IOC turnaround

Indian Oil Corporation has reported a net profit of Rs 3,121.89 crore for the second quarter ended September against a net loss of Rs 450.24 crore a year ago, on account of higher refinery margins and lower inventory losses.

"Last year, we had a huge inventory loss of Rs 5,134 crore. This year, we had a loss of much lower proportion at Rs 686 crore," chairman B. Ashok told reporters here.

IOC earned $4.32 on turning every barrel of crude into fuel during the period compared with a gross refining margin of $0.90 per barrel.