Kesoram Industries, the flagship of Basant Kumar Birla Group, has announced a fresh round of restructuring, involving spinning off the tyre business into a separate entity.

The plan entails mirror demerger of the cement and the tyre businesses and listing the demerged entity on the bourses, subject to shareholder and regulatory approvals.

The company management said the exercise would bring clear focus on the two businesses, which are unrelated to each other, and unlock value for shareholders.

Moreover, the demerger will pave the way for the Manjushree Khaitan (executive vice-chairman and daughter of B.K. Birla) led management to bring in a strategic partner or private equity funding for the loss-making Birla Tyres.

The Telegraph had first reported about the impending restructuring involving the demerger of the tyre division on November 22.

For every share held in Kesoram, shareholders will get one share of Birla Tyres, which will be listed on the bourses. The appointed date of the scheme has been set as January 1, 2019.

Stock market participants believe the Kesoram stock will be re-valued on the basis of the cement business coming out of the overhang of the tyre division.

The transaction fuelled speculation that this would pave the way for Kumar Mangalam Birla, grandson of B.K. Birla and chairman of UltraTech Cement (India’s largest cement maker), taking up an active role in the demerged Kesoram.

However, sources said such a possibility, if any, was unlikely at this juncture.

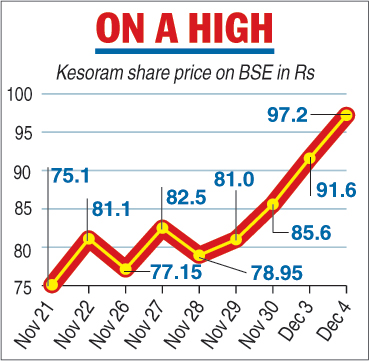

The Kesoram stock on Tuesday closed at Rs 97.50, up Rs 6.05, or 6.62 per cent on the National Stock Exchange with very high volume of trades. The stock has gained as much as 55.6 per cent in the last nine trading sessions.

Contours of the deal

The demerger will lead to the splitting of debt between the two entities. While the cement business will carry on with Rs 2,400 crore of debt, around Rs 1,000 crore will be transferred to Birla Tyres, a senior company official said, adding that the apportionment would follow the provisions of the Income Tax Act, 2013.

Telegraph infigraphic

“This (demerger) will open up multiple options to grow the businesses separately. We can now attract private equity funding or even a fresh round of bank funding,” the official explained.

Even as Kesoram pared close to Rs 600 crore debt in four quarters ended September 30, 2018, it remain at an elevated level.

The cement business, which has plants in Andhra Pradesh and Karnataka of 7.5-million-tonne capacity, clocked a turnover of Rs 2,251 crore, according to the results of the last fiscal and Rs 127 crore of profit before tax and interest.

The tyre business, located in Balasore, Odisha, in contrast, had a turnover of Rs 1,453 crore and a loss of Rs 128.9 crore on pre-tax and interest basis in 2017-18, according to data available on the Bombay Stock Exchange. The tyre division produces only commercial vehicle tyres.

Tuesday’s announcement culminates a spate of restructuring exercise Kesoram had undertaken in the recent past.

To shave off a mountain of debt that touched Rs 5,300 crore to push the company to the brink of sickness, Kesoram sold off the Laksar tyre plant in February 2016 to JK Tyre and cut debt by Rs 2,700 crore.

Moreover, promoters brought in Rs 665 crore by way of subscribing to a rights issue and preferential allotment.

The company suffered a loss of Rs 96.25 crore from a Rs 926.15 crore revenue in the July-September quarter, after paying Rs 105.26 crore as interest and a segment loss of Rs 19.87 crore on tyres. Cement made a pre-tax profit of Rs 32.65 crore in that period.