The Sensex tanked on Monday and gold gained lustre as investors feared the West Asian crisis would cripple global growth even as they took comfort in the safe-haven yellow metal.

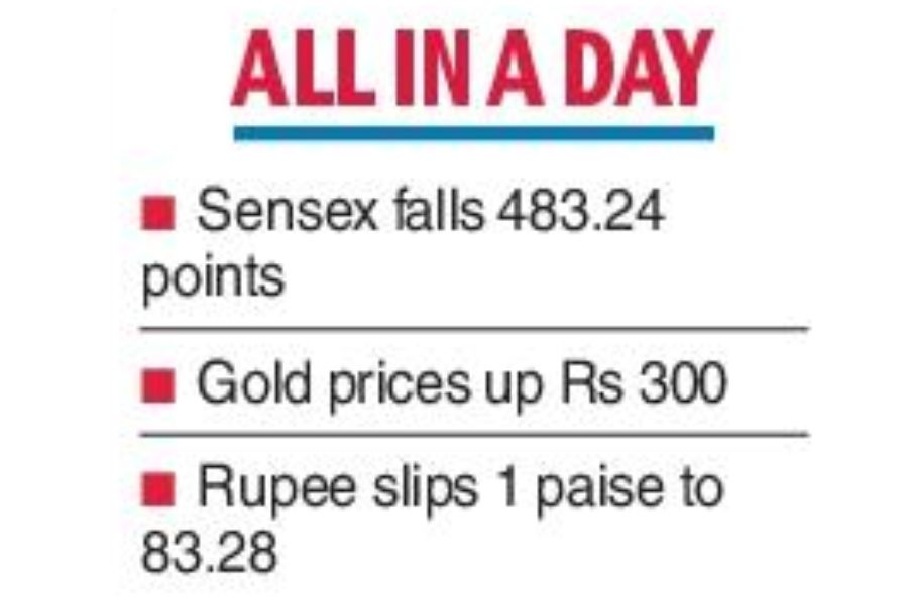

The BSE bellwether slumped over 483 points with rising crude prices testing the nerves of a market fretting over elevated interest rates and dogged inflation, globally.

Gold prices jumped Rs 300 to Rs 58,350 per 10 grams in the national capital on Monday. "Geopolitical concerns cause a new wave of worldwide risk aversion, which helps safe haven assets like gold," Saumil Gandhi, senior analyst of commodities at HDFC Securities, said.

Shrikant Chouhan, head of research (retail), Kotak Securities Ltd, said: ``There are concerns that since most of the oil-producing nations are close to the conflict zone, a prolonged war could trigger an upsurge in international crude oil prices.’’

At a stock-specific level, the conflict impacted Adani Ports & Special Economic Zone (APSEZ), which had acquired Haifa port in Israel for $1.2 billion earlier in the year.

APSEZ shares fell 4.89 per cent to Rs 789.90. "We are closely monitoring the action on ground which is concentrated in South Israel, whereas Haifa port is situated in the North.’’

The overall contribution of Haifa in APSEZ’s numbers is 3 per cent of the total cargo volume, APSEZ said.