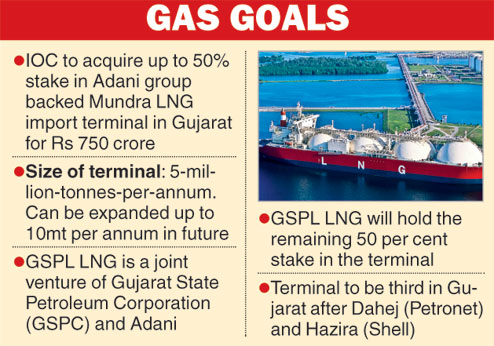

New Delhi, Aug. 4: Indian Oil Corporation will acquire up to 50 per cent in the Adani group-backed Mundra LNG import terminal in Gujarat for about Rs 750 crore.

The board of India's largest oil company gave an "in-principle approval for the stake buy in GSPL LNG, which is setting up a 5-million-tonnes-per-annum LNG terminal at Mundra port in Gujarat", the company said in a statement.

GSPL LNG is a joint venture of Gujarat State Petroleum Corporation (GSPC) and Adani Enterprises.

GSPL LNG will hold the remaining 50 per cent stake in the LNG terminal that is nearing completion. Adani and GSPC are equal partners in GSPL LNG.

Officials said fresh equity would be infused into the project and there is a possibility that IOC could have a majority stake. They said GSPL and Adani would continue to remain partners in the project.

"The fresh evaluation of the project is being done to assess the real value of the LNG terminal before deciding on the new equity structure and stakes for different partners in the project," officials said.

While the company did not give the acquisition cost, an official said roughly 30 per cent of the Rs 5,040-crore project cost is equity and IOC would pay half of it. A final number would be arrived at after the valuation exercise is completed, he said.

The Mundra terminal can be expanded up to 10 million tonnes per annum in the near future.

IOC target

The move is part of IOC's plans to diversify its energy portfolio to meet the future needs of the country. As the second largest player in natural gas in the country, IOC is making significant investments in natural gas infrastructure and marketing in line with the country's changing energy mix, IOC said.

The LNG terminal will be commissioned in the fourth quarter of 2017-18. It will have receipt, storage and re-gasification facilities for liquefied natural gas (LNG) and will be connected to Gujarat State Petronet's (GSPL) existing pipeline network at Anjaar (Gujarat).

"We already have investments across the gas value chain from LNG import terminals to city gas distribution networks, the major among them being a 5-million-tonne LNG import terminal at Kamarajar port near Chennai, scheduled for commissioning in 2018-19," IOC chairman Sanjiv Singh said.

The proposed terminal at Mundra is the third in Gujarat. Petronet has an LNG import facility at Dahej, while Shell has a 5 mt terminal at Hazira. Mundra would be the second LNG project of Adani where IOC is investing.

The PSU has taken a 39 per cent stake in the proposed 5mt-a- year LNG import terminal at Dhamra in Odisha. The Adani group has 50 per cent in the project and the remaining 11 per cent is with GAIL.

When GSPL LNG offered a stake in the Mundra LNG project 3-4 years back, eight firms, including GAIL, had expressed interest in buying the stake but only three were shortlisted.

Besides IOC, India Gas Solutions - the equal joint venture between Mukesh Ambani-led RIL and Europe's BP - and state-owned ONGC were shortlisted.

The IOC board also approved the expansion of its Gujarat refinery to 18 million tonnes a year. from 13.7mt.