The Centre stressed on Wednesday that the autonomy of the Reserve Bank of India (RBI) is “essential” as it sought to calm investors worried about a growing public quarrel with the central bank.

Stocks and bonds fell and the rupee weakened earlier in the day amid reports that RBI governor Urjit Patel may consider resigning given the reported breakdown in relations.

The media reports also said that the government had invoked never-before-used powers to issue directions to the central bank governor on matters of public interest.

In a statement issued hours later through the finance ministry, the government said the RBI’s independence was “an essential and accepted governance requirement”.

The government added that it would continue to carry out extensive consultations with the central bank to give its assessments on issues and suggest possible solutions.

But it was unclear if it had used powers for the first time under the RBI Act to give the bank instructions.

Two Indian television channels reported earlier in the day that Patel might resign. The RBI declined to comment.

“The statement is ambiguous and does not fully clarify the issues at hand,” said A. Prasanna, the chief economist at ICICI Securities Primary Dealership, in Mumbai. “Still it does sound like the finance ministry is trying to dial down the temperature.”

One news report had said that the Section 7 powers had been invoked on issues ranging from liquidity for non-banking finance companies, to capital requirements for weak banks and lending to small- and medium-sized companies.

Indian markets clawed back some early losses after the statement but still appeared tentative.

Benchmark stock indexes BSE and NSE rose around 1 per cent, while the rupee was at 73.85 to the dollar, up from a low of 74.14 but still down on the day.

The 10-year benchmark bond yield was at 7.87 per cent from its previous close of 7.83 per cent.

Tensions between the RBI and the government mushroomed after RBI Deputy Governor Viral Acharya said on Friday that undermining central bank independence could be “potentially catastrophic”, indicating the authority was pushing back against government pressure to relax its policies and reduce its powers ahead of general elections due by May.

Investors are worried that a prolonged row between the government and the RBI could impact decision-making when India's financial markets have been hit hard by a series of debt defaults by one of the largest infrastructure funding companies. That has led to a liquidity crunch in the entire non-banking finance sector.

“We have a fairly fragile financial system, between the public sector banks and non-banking financial companies,” said Dhananjay Sinha, head of institutional research at Emkay Global Financial Services.

“If RBI's top brass exits, there is a likelihood of instability that will be perceived, and that can have an impact on the economy and the market at large.”

India's $2.6 trillion economy surpassed France's in 2017 to become the world's sixth largest, and is not far behind that of the UK, according to World Bank data.

Acharya's speech came after a long-running spat between the government and the RBI over whether the central bank should part with some of its Rs 3.6 trillion ($48.73 billion) of reserves to help fund the country's fiscal deficit.

Government officials have also called for the RBI to relax strict lending rules for weak banks and are trying to trim the RBI's regulatory powers by setting up a new payment regulator.

Finance minister Arun Jaitley on Tuesday blamed the central bank for failing to stop a lending spree during 2008-2014 that left banks with $150 billion of bad debt.

Patel and his deputy governors are expected to meet top finance ministry officials on Friday. TV channels said Patel has called for a full RBI board meeting on November 19.

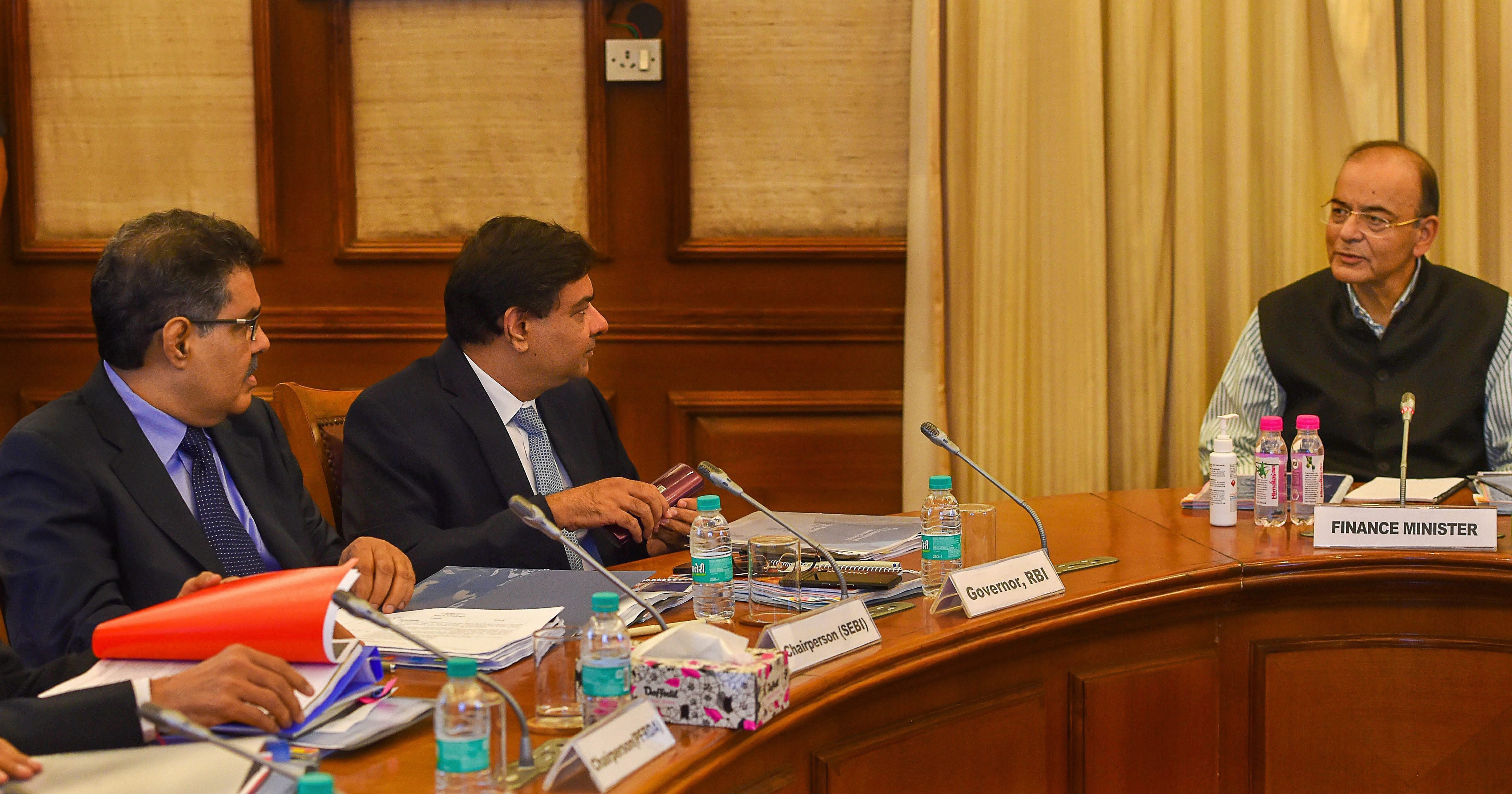

Finance minister Arun Jaitley with RBI governor Patel (second from left) and SEBI chairperson Ajay Tyagi at the meeting of Financial Stability and Development Council in New Delhi on October 30. PTI