Reliance Industries Ltd (RIL) on Sunday announced another deal in digital services with General Atlantic investing Rs 6,598.38 crore for a 1.38 per cent stake in Jio Platforms Ltd.

This is the fourth transaction in Jio Platforms in less than four weeks. Jio Platforms has now raised Rs 67,194.75 crore from technology investors that include Facebook, Silver Lake Partners, Vista Equity Partners and General Atlantic.

Strategic and financial investors are expected to hold 20 per cent equity in Jio Platforms. Among the four deals, Reliance has sold 14.8 per cent in Jio Platforms and more such investments are likely in the near future.

A press statement from RIL said that the investment values Jio Platforms at an enterprise value of Rs 5.16 lakh crore. The deal value is similar to the other three preceding transactions.

“I am thrilled to welcome General Atlantic, a marquee global investor, as a valued partner. I have known General Atlantic for several decades and greatly admired it for its belief in India’s huge growth potential…We are excited to leverage General Atlantic’s proven global expertise and strategic insights across 40 years of technology investing for the benefit of Jio,” Mukesh Ambani, chairman and managing director of RIL, said.

Sources close to RIL said the investment reaffirms Jio as a next-generation software product and platform company and the deal is also an endorsement of its tech capabilities and the potential of the business model in a Covid-19 world.

The investment comes at a time RIL is set to kick off its rights issue to garner over Rs 53,100 crore. The issue will open for subscription on May 20 and close on June 3.

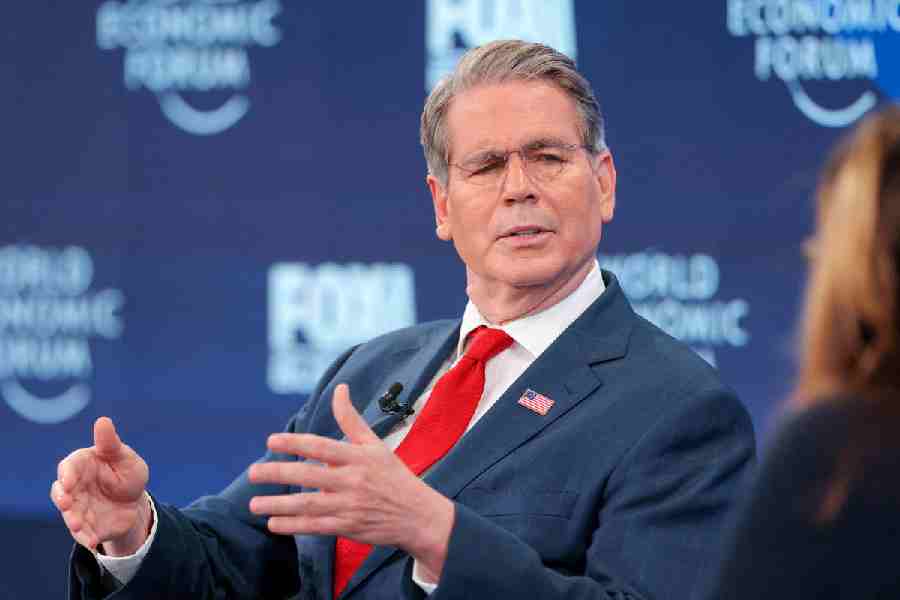

“As long-term backers of global technology leaders and visionary entrepreneurs, we could not be more excited about investing in Jio. We share Mukesh’s conviction that digital connectivity has the potential to significantly accelerate the Indian economy and drive growth across the country,” Bill Ford, chief executive officer of General Atlantic, said.

General Atlantic is a leading global growth equity firm with a 40-year track record of investing in the technology, consumer, financial services and healthcare sectors. It has backed companies such as Airbnb, Alibaba, Ant Financial, Box, ByteDance, Facebook, Slack, Snapchat, and Uber and other global technology leaders.

The RIL chief had in August last year set a target of making the company net debnt free by March 2021. Following the string of transactions in Jio Plaforms, the rights issue and the possibility of more stake sale to companies like Saudi Aramco, the target is likely to be achieved by December.

At the end of March quarter, Reliance had an outstanding debt of Rs 3,36,294 crore and cash in hand of Rs 1,75,259 crore. After adjusting cash, the net debt came to Rs 1,61,035 crore.