Abu Dhabi sovereign investment firm Mubadala has joined the Jio Platforms bandwagon, while Silver Lake has raised its stake in the company.

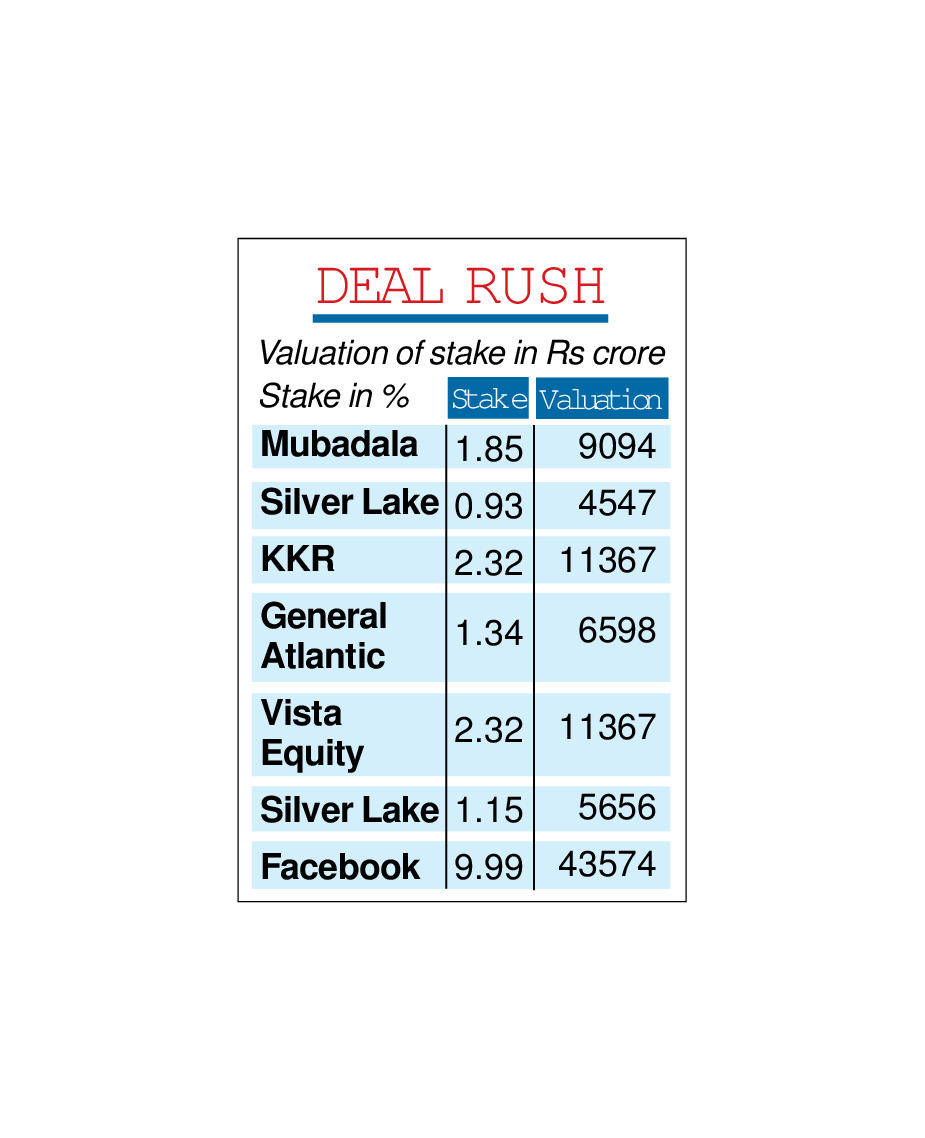

Reliance Industries on Friday announced that Mubadala Investment Company will plough in Rs 9,093.60 crore for a 1.85 per cent stake in Jio Platforms — the sixth big name to bet on Mukesh Ambani’s digital services business in six weeks that include Facebook, Silver Lake, Vista Equity Partners, General Atlantic and KKR.

In a late evening disclosure, it also announced another transaction wherein Silver Lake (Silver Lake) and its co-investors will invest an additional Rs 4,546.80 crore in Jio Platforms, in addition to the Rs 5,655.75 crore investment announced on May 4.

This would bring the aggregate investment by Silver Lake and its co-investors to Rs 10,202.55 crore.

Like the Mubadala transaction, Silver Lake’s investment values Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore. However, it will translate into a 2.08 per cent equity stake in Jio Platforms. With this investment, Jio Platforms has raised Rs 92,202.15 crore from leading technology investors in less than six weeks.

Reliance has now sold a combined 21 per cent interest in Jio Platforms, which houses movie, music apps and telecom venture Jio Infocomm.

Sources said that the fresh investments are another strong endorsement of the latter’s tech capabilities, disruptive business model and secular long-term growth potential.

“I am delighted that Mubadala, one of the most astute and transformational global growth investors, has decided to partner us in our journey to propel India’s digital growth towards becoming a leading digital nation in the world. We look forward to benefiting from Mubadala’s experience and insights from supporting growth journeys across the world,’’ Mukesh Ambani, chairman and managing director of RIL, said.

Mubadala is a sovereign investor managing a global portfolio for its shareholder, the government of Abu Dhabi. It manages a $229 billion portfolio in five continents with interests in multiple sectors, including aerospace, semiconductors, metals and mining, renewable energy, oil and gas, petrochemicals, utilities, and healthcare.

“We are committed to investing in, and actively working with, high growth companies which are pioneering technologies to address critical challenges and unlock new opportunities. We have seen how Jio has already transformed communications and connectivity in India, and as an investor and partner, we are committed to supporting India’s digital growth journey,’’ said Khaldoon al Mubarak, managing director and group CEO, Mubadala Investment Company.