The slowdown in the economy will put pressure on Prime Minister Narendra Modi’s re-elected government and the Reserve Bank of India to provide stimulus through fiscal measures and interest rate cuts.

The RBI has already cut the policy rate twice this year by a cumulative 50 basis points and the speculation has started to grow that it might trim it again by 50 basis points in one stroke, taking the repo rate down to 5.5 per cent, when it winds up a three-day MPC meeting on June 6. The rate cuts have failed to ignite a faltering economy amid a liquidity shortage and little enthusiasm in the private sector to boost investment.

Officials in the finance ministry have said that new finance minister Nirmala Sitharaman could toy with the idea of cutting taxes when she presents her budget on July 5. But she will have to wrestle with the problem of capping fiscal deficit that the Modi government has promised to cap at 3.4 per cent of GDP.

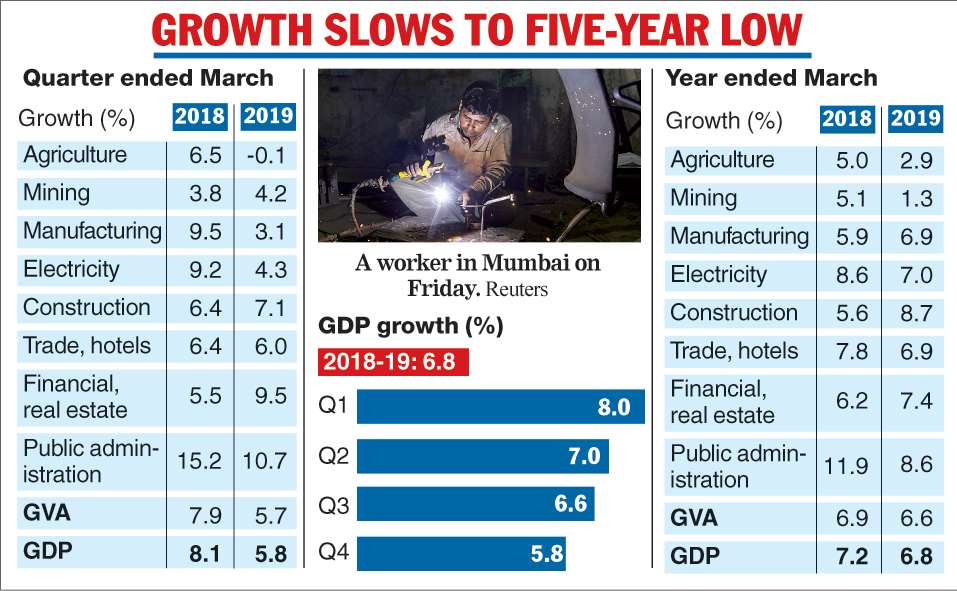

On Day 1 of the new government, CSO data showed that economic growth slowed to a five-year low of 5.8 per cent in the fourth quarter of 2018-19 because of a poor showing by agriculture and manufacturing. Growth for the whole year slowed to 6.8 per cent from 7.2 per cent in 2017-18. Growth in terms of gross value-added fell to 5.7 per cent in the fourth quarter against 7.9 per cent a year ago.

Sector performance

Growth in the farm sector contracted 0.1 per cent in the March quarter, even as mining expanded by 4.2 per cent.

Manufacturing grew 3.1 per cent, electricity 4.3 per cent, construction 7.1 per cent, trade 6 per cent, financial services 9.5 per cent and public administration 10.7 per cent.

“The big concern is that the slowdown appears to continue even in the ongoing financial year and we expect the economy to grow at below 7 per cent for the second straight year and there is a need for improving the quality of public expenditure,” said N.R. Bhanumurthy of the National Institute of Public Finance and Policy.

Key numbers

The ratio of private final consumption expenditure (PFCE) to GDP at current and constant (2011-12) prices during 2018-19 is estimated at 59.4 per cent and 56.9 per cent, respectively, against 59 per cent and 56.3 per cent, respectively, in 2017-18.

In terms of GDP, the ratio of gross fixed capital formation (GFCF) to GDP at current and constant (2011-12) prices during 2018-19 has been estimated at 29.3 per cent and 32.3 per cent, respectively, against the corresponding rates of 28.6 per cent and 31.4 per cent, respectively, in 2017-18.

Opposition reaction

The Congress party, nursing its wounds after a mauling in the recent election, was uncharacteristically reserved in it comments . The party said in a tweet: “GDP growth at 5.8 per cent, slowest pace in two years. We hope the new government will take strong measures to address this issue.” But others on social media were less sparing in their criticism.

“I wonder how the new NDA government will handle and clear the economic mess created by the old NDA government in the past five years,” tweeted Somen Mitra, the Pradesh Congress chief of the party’s Bengal unit.

Infrastructure growth

The growth of eight core sectors slowed down to 2.6 per cent in April. In April 2018, the sectors grew at 4.7 per cent.

Growth in coal was flat at 2.8 per cent in April 2019, while output of electricity and refinery products was 5.8 per cent and 4.3 per cent, respectively. Crude, natural gas, and fertilisers fell during the month.