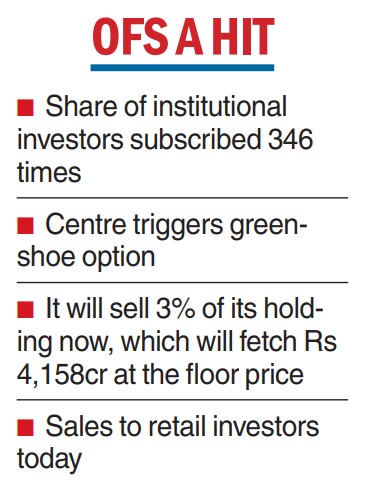

The offer-for-sale of Coal India Ltd — the first disinvestment exercise in this fiscal — got off to a rousing start on Thursday with the quota of institutional investors subscribed 346 per cent that led to the government exercising its greenshoe option to sell more shares from its holding.

The Centre had offered over 8.31 crore shares to institutional investors on Thursday, and it received bids for 28.76 crore shares or 3.46 times that are worth Rs 6,500 crore at an indicative price ofRs 226.12 a share.

Retail investors will subscribe to their quota on Friday

The Centre. which holds 66.13 per cent of CIL, has set a disinvestment target of Rs 51,000 crore for the fiscal.

In the two-day OFS, the government is selling over 18.48 crore shares or 3 per cent of the coal producer at a floor price of Rs 225 a share. The sale includes a greenshoe option of 1.5 per cent in case of over-subscription. At the floor price, the Centre can raise Rs 4,158 crore from the OFS.

“Offer-For-Sale in CIL received an enthusiastic response from non-retail investors on Friday. The issue was subscribed 3.46 times the base size. The government has decided to exercise the greenshoe option. Retail investors get to bid on Friday,” department of investment and public asset management secretary Tuhin Kanta Pandey tweeted.

The floor price marked a discount of 6.7 per cent to the closing price of Coal India on the BSE on Wednesday that offered an arbitrage opportunity to the investors who sold their shares — for purchase in OFS —resulting in the scrip settling at Rs 230.55 against the previous close of Rs 241.20 — a drop of 4.42 per cent or Rs 10.65. At the closing price, Coal India has a market cap of Rs 1.42 lakh crore on the BSE.

IDBI Bank

IDBI Bank is a major divestment exercise for this fiscal. The government and Life Insurance Corporation are jointly selling about 61 per cent stake in IDBI Bank and had in January received multiple expressions of interest (EoIs). In October last year, DIPAM invited EoIs for selling a 30.48 per cent stake in IDBI Bank, along with LIC’s 30.24 per cent stake in the lender.

The government and LIC together hold a 94.72 per cent stake in IDBI Bank, which will come down to 34 per cent after the strategic sale.

The Centre also plans to sell its entire 64 per cent stake in Shipping Corporation of India (SCI). Recent reports said the government is expecting to earn Rs 6,000 crore from the sale.

CIL output

Coal India Ltd has reported a 9.5 per cent year-on-year rise in monthly production to a record 60 million tonnes in May 2023.

The miner, along with its subsidiaries, had produced 54.7mt of coal a year ago.