India is lagging behind in the manufacture of batteries for electric vehicles, according to Rajeev Chaba, managing director of MG Motor India, which recently launched an electric SUV in the country.

In the absence of manufacturing capabilities, most players will import battery cell modules and assemble them in the country.

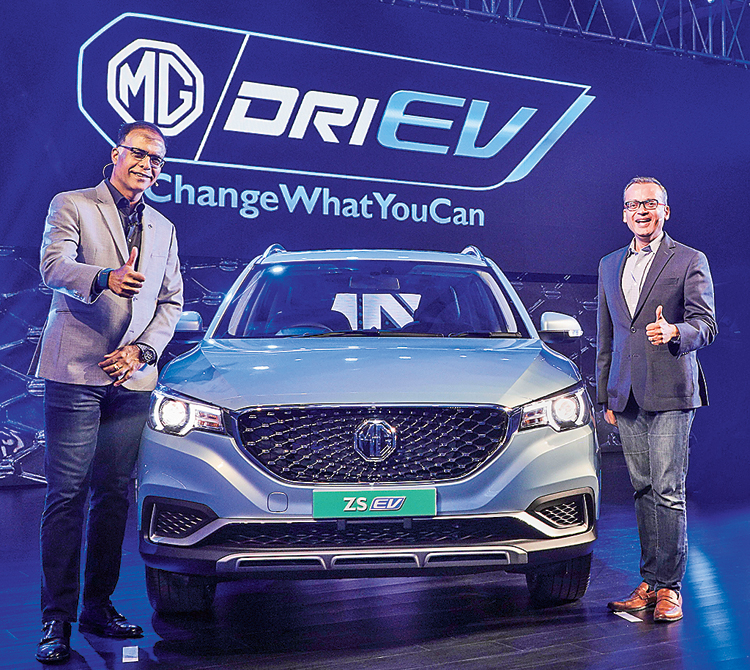

“Companies here can invest in EV battery assembly plants but manufacturing battery cells is still controlled by a handful of global players such as BYD, LG, Panasonic, Samsung, Tesla and China-based Contemporary Amperex Techonology Co Limited (CATL),” Chaba said at the launch of MG Motor India’s first electric SUV — ZS — in New Delhi earlier this month.

SAIC, the Chinese parent company of MG Motor, has tied up with CATL, which specialises in manufacturing lithium-ion batteries and storage systems at its plant in Liyang city, Jigansu province.

SAIC Motor and CATL has set up two companies — one is United Auto Battery Corporation, where CATL has a stake of 51 per cent and SAIC a 49 per cent stake. The company makes lithium ion batteries.

The other company, United Auto Battery Services, specialises in energy storage systems. SAIC holds a majority 51 per cent stake in this entity.

Jun Zhu, head of EV technology, SAIC, said costs have come down rapidly. “Five years ago, CATL could produce 1kWh battery at 5,000 RMB (1 RMB equals Rs 10), now it can produce 1kWH battery at 1,000 RMB. In another few years, the cost reduction will be 10 per cent.”

This has been possible because of increased energy density in the battery cells. “In the first EV we produced, the energy density was 81 watt hour per kg. In the MG ZS EV, it is 161 watt hour per kg, almost double,” Zhu said.

The life expectancy of EVs, too, have increased. “The life of a battery is equal to the life of the car,” said Chaba.

Whereas earlier batteries had a life expectancy of six years, EV taxis in China can operate for 600,000 kilometres.

On when the prices of EVs would be on a par with internal combustion engines (ICEs), Zhu said: “We need to reduce costs of EVs by 30 to 40 per cent to be comparable with ICEs. This can happen with volume increase together with technology change.”

“Energy density is the most important thing. The first electric car with 300kWh battery could give a range of 150km whereas the ZS with 45 kWh will give a range of 340km. We are working on a battery that will be able to store 72kWh of energy.”

The aim for SAIC and CATL is to bring down the battery cost to $100 per kWh. “Globally, the battery cost is $250 per kWh, ours is at $175 per kWh. So, we already have an advantage,” said Chaba.