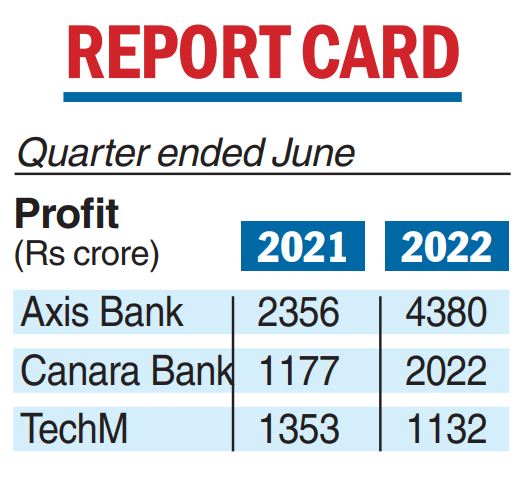

Axis Bank on Monday reported an 86 per cent jump in its consolidated June quarter net profit at Rs 4,380.59 crore, helped by a steep fall in the amount set aside for bad loans.

On a standalone basis, the third largest private sector lender witnessed a 91 per cent increase in the net profit at Rs 4,125.26 crore. Its core net interest income grew 21 per cent to Rs 9,384 crore on the back of a 14 per cent growth in advances and a 0.14 per cent expansion in the net interest margin at 3.60 per cent.The overall non-interest income declined 11 per cent to Rs 2,999 crore, primarily driven by a Rs 667 crore reversal in treasury operations because of mark-to-market losses as the yields hardened. The core fee income was up 34 per cent to Rs 3,576 crore.

The bank’s provisions came down to Rs 359.36 crore from Rs 3,302.30 crore in the year-ago period and Rs 987.23 crore for the preceding March quarter, helping the bottom line the most.

Canara Bank

Canara Bank has seen a 71.79 per cent growth in net profit at Rs 2,022 crore for the April-June quarter of 2022-23, driven by an increase both in interest as well as non-interest income.

The bank’s interest income during the quarter grew 8.29 per cent to Rs 18,177 crore, while non-interest income grew 24.55 per cent to Rs 5,175 crore over the corresponding period the previous year.

“During the quarter, other than interest income, we have focussed on growing our non-interest income as well. Going forward in the second quarter of FY23, there will be good traction in net interest income and also non-interest income,” said Canara Bank MD and CEO L.V. Prabhakar.

The bank’s gross non-performing assets during the quarter were at 6.98 per cent compared with 8.5 per cent in the corresponding quarter of the previous year.

The bank raised AT-1 bonds of Rs 2,000 crore on July 19 at 8.24 per cent as part of the capital raising programme. The public sector lender has planned to raise Rs 9,000 crore during FY23, which includes tier 1 bonds of Rs 5,500 crore and tier 2 bonds of Rs 3,500 crore.

TechM profit slides

Software exporter Tech Mahindra on Monday reported a 16.4 per cent slide in June quarter net at Rs 1,132 crore as its profit margins narrowed because of a slew of factors.

The Mahindra group company, which is the fifth largest IT exporter in the country, had posted a net profit of Rs 1,353 crore in the year-ago period.