|

Mumbai, March 6: Shares of AstraZeneca Pharma India tanked on the bourses today after the drug firm’s Swiss parent said it would bring down its stake in the company to comply with the minimum shareholding norms of the Securities and Exchange Board of India (Sebi).

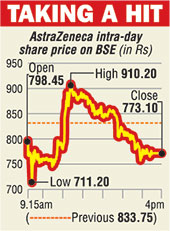

On the Bombay Stock Exchange, the AstraZeneca share plummeted 7.27 per cent, or Rs 60.65, to Rs 773.10. The scrip hit an intra-day low of Rs 711.20 during the day, a drop of nearly 15 per cent over the previous close of Rs 833.75.

In a statement to the stock exchanges, AstraZeneca Pharma India said its promoter shareholder — AstraZeneca Pharmaceuticals AB Sweden — had informed the Indian entity of its decision to “reduce shareholding in the company in order to comply with the requirement of minimum public shareholding, as specified in the Securities Contracts (Regulation) Rules, 1957, subject to receipt of all necessary statutory and regulatory approvals, as may be required, appropriate market conditions and investor interest”.

At present, the Swiss parent holds around 89.99 per cent stake in the company. According to market circles, the scrip came under selling pressure as there were expectations that the parent would buy the remaining stake from the market and delist the firm.

“The stock could continue to come under pressure because of the equity dilution,” a broker said.

Market regulator Sebi has given private firms time till June to bring down their minimum public shareholding to 25 per cent. For those in the public sector, the minimum shareholding stands at 10 per cent and this has to be completed by August.

Meanwhile, realty major DLF said it would issue fresh equity shares to dilute the promoter group holding in the company to meet the minimum shareholding norm.