|

| Caption |

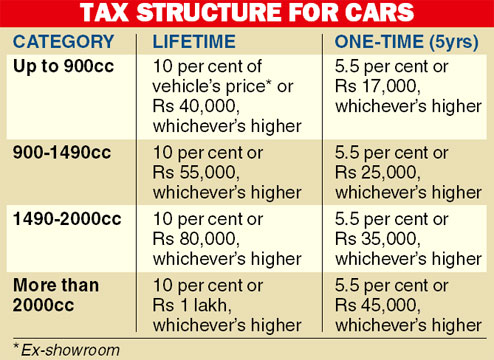

The government on Friday said owners of cars and two-wheelers could opt for lifetime payment of tax from September 3, a practice widely followed across the country.

Officials did not say how much they were expecting to mop up through the move but sounded hopeful of generating enough funds to pay a chunk of the Rs 600crore subsidy announced for the five transport corporations.

“This is the first time Bengal is introducing lifetime tax for vehicles. It will be applicable to private cars and two-wheelers. The existing system of paying tax once in five years will remain,” transport minister Madan Mitra said.

The tax structure has been so planned that one would stand to benefit by opting for the new system. However, the five-year tax paid before September 3 would be around Rs 2,000 less for any category of car than what would have to be paid after the new structure comes into effect.

The government said if an owner switched states after paying lifetime tax, he or she would be entitled to a refund from the original state after paying for re-registration in the new state.

“The new tax structure has been prepared after considering the models followed by various states. For Bengal, the tax would be calculated on the basis of the ex-showroom price of a vehicle and there will no separate tax for ACs or music systems,” said transport secretary B.P. Gopalika. “We are soon developing a gateway to offer facilities for e-payment.”

For models that have become obsolete, the calculation will be done on the last market price of the model.