Calcutta: Payment in EMIs, popular with buyers of homes and consumer durables, has been a non-starter in the health-care industry despite its potential to help thousands who pay through their nose to get treated at private hospitals.

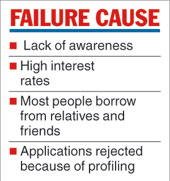

Lack of awareness and high rates of interest for a section of the people are among the factors responsible for the failure of the scheme, which some private hospitals introduced after the demonetisation of Rs 500 and Rs 1,000 notes in November 2016.

Several private hospitals said the finance companies they had tied up with to offer the equated monthly instalment (EMI) scheme to patients had wound up their help desks in the absence of takers.

"The finance firm offering the service at our hospital has almost withdrawn," said an official at RN Tagore International Institute of Cardiac Sciences in Mukundapur, off the Bypass.

Sudipta Mitra, the chief executive of Peerless Hospital, also off the Bypass, said the scheme "has practically no takers". The company the hospital has tied up with offers the the EMI scheme to patients in need of stent or pacemaker implant, and cataract and open-heart surgeries.

An official of Arogya Finance, which offers medical loans and is the biggest player in the segment, said it had provided the scheme to 250-odd people in Bengal over the past year. To put things in perspective, thousands get admitted to private hospitals across the state daily.

"One reason why the scheme has not taken off is lack of awareness," said Jose Peter, co-founder and CEO of Arogya Finance.

"Most of the patients undergoing expensive treatments arrange for funds before coming to the hospital. They borrow money from friends and family members or take personal loans," he said.

Studies have shown that around 50 per cent of the people facing medical emergencies borrow money. "Most do not know that the EMI option is available," Peter said.

The interest rates the company offers vary between zero and 17 per cent. It relies more on psychometric test than an assessment of the credit history of applicants before releasing money.

In the psychometric test, a loan applicant has to answer a set of 40 questions. The answers reveal a person's willingness to pay, Peter said.

"There are three categories of patients: economically deprived, lower middle class and upper middle class or affluent section," said R. Venkatesh, zonal director, east, Narayana Health, which owns RN Tagore hospital.

"Generally, people in the third category have a higher CIBIL (Credit Information Bureau (India) Limited) score because of their sound financial condition and are offered a lower interest rate. The patients in the other two categories have a lower CIBIL score and are offered a higher rate. A poor patient may be charged a rate that is double the rate offered to an affluent person. Because of high interest burden, people in the first two categories tend to stay away from medical loans."