|

Car owners in the state are likely to soon have the option of paying road tax on their vehicles at one go. Those who do not want to pay the “lifetime tax” would be able to pay the tax once every five years, as is done now.

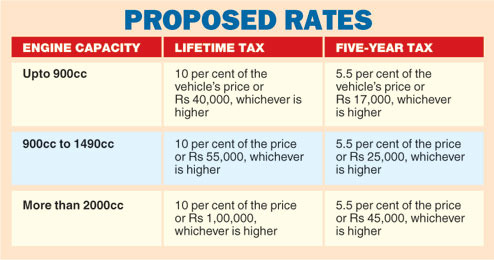

The transport department is expected to place a bill in the Assembly on Thursday to introduce the “lifetime tax” provision and rationalise how road tax is calculated.

“Once the bill is passed, the road tax on a car will depend on its ex-showroom price and its engine capacity, measured in CC. Most Indian states calculate road tax this way and offer car owners the option of paying lifetime tax. We cannot afford to lag behind. Those not willing to pay lifetime tax will continue to have the option of paying up every five years,” said a senior official of the department.

“Several factors, like whether the car has AC or not, is considered while determining the road tax now. We want to make things simple under the new system. A car owner who pays lifetime tax will not have to pay road tax on the same vehicle ever again,” added the official.

The department top brass claimed the changes were for the benefit of car owners but sources said the cash-strapped government was much more concerned about filling up its own coffers.

The proposed tax rates were finalised on Wednesday evening. Those with “low-end, non-AC” vehicles with engine capacity up to 800cc are likely to get a discount of Rs 10,000 on lifetime tax or Rs 3,000 on tax for five years.

According to officials, those who have paid road tax for five years will have the option of paying lifetime tax at a separate rate fixed by taking into account the number of years their cars have already been used. The owners of such cars can also continue paying road tax every five years.

“Those who want to junk their car cancelling its registration will be refunded a portion of the road tax depending on the number of years it has been used,” said an official.