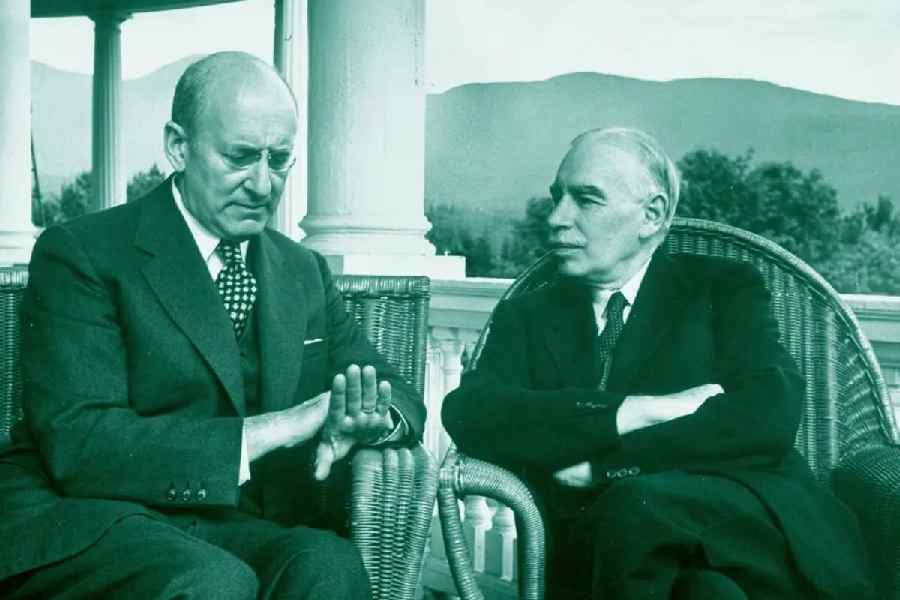

In the summer of 1944, as the Allied forces pushed through Normandy during the decisive campaign of the Second World War, the economist, John Maynard Keynes — already worn down by illness and overwork — stood at the centre of what would become one of the most consequential economic gatherings of the 20th century. At Bretton Woods, he proposed a post-War financial system designed not just to stabilise currencies but to also prevent the build-up of unsustainable trade imbalances. His remedy was an International Clearing Union: a global accountant that would issue a supranational currency called Bancor that would nudge debtors and creditors to keep their books in order. He foresaw that hoarding surpluses without boosting global demand might lead to instability. Though he was ignored then, today’s trade wars reflect his concerns. His insight is still relevant and offers valuable guidance as we confront the economic disorder of our time.

Keynes anticipated the contours of today’s predicament. A preview of this disparity first unfolded in Europe in the late 1990s and the 2000s when Germany’s manufacturing engine gained dominance within the eurozone. Through industrial precision and fiscal restraint, it became the world’s largest exporter. But its rise was enabled as much by structure as by skill: a shared currency denied other member states the option of devaluation even as their domestic industries eroded. Countries like Greece, Spain, and Italy ran persistent trade deficits, importing high-value German goods without the policy tools to restore competitiveness.

China added scale and scope to that approach after joining the World Trade Organization, creating the world’s fastest-growing major economy and lifting hundreds of millions out of poverty. Its export-led boom was powered by vast investments in infrastructure and relentless workforce skilling, but was also aided by currency suppression, broad-based State subsidies, and preferential credit for exporting industries. Both China and Germany absorbed global demand while generating too little domestic consumption of their own — a dynamic that weakened industrial capacity in other trade-dependent economies and eroded competitiveness in ways that have proved difficult to reverse.

India’s manufacturing ambitions were constrained by this global context. Some sectors, like handloom textiles and hand-knotted carpets, endured on the strength of tradition, skill, and labour intensity. But many others — such as furniture manufacturing, which depends on scale and coordinated supply chains — struggled against efficient and cost-competitive imports. While construction and services absorbed much of the expanding urban workforce, India missed the productivity gains and value-chain integration that manufacturing uniquely offers. In a global environment shaped by highly competitive manufacturing powerhouses supported by an enabling ecosystem, Indian industries found it challenging to scale manufacturing on fair and equitable terms.

Our domestic challenges compounded the problem further. Skilling gaps, limited access to capital, high power costs, and outdated regulations — such as the Factories Act, which restricted labour flexibility — left manufacturing hovering at around 15% of GDP, a figure that has barely shifted in a decade. The legacy of the licence-permit era persists in fragmented land-use norms, unclear zoning, and regulatory bottlenecks. In tea-growing regions, for instance, where demand cannot absorb global oversupply, repurposing underutilised land for industrial or ecologically compatible uses remains mired in procedural ambiguity. These constraints have long defined the limits of India’s economic potential. But the emerging global realignment — shaped by strategic decoupling and regionalisation — presents a narrow but meaningful window to shift that trajectory.

In this landscape, India is uniquely positioned and stands to benefit from the reordering of global supply chains, but only if it avoids complacency bred by the comfort and the protection of its domestic market and commits to strengthening industrial capacity. Trade policy, once passive, is becoming more strategic: forging free trade agreements with the United States of America, the United Kingdom and the European Union; aligning with blocs like the Quad; and expanding production-linked incentives. If India continues to build internal demand alongside external competitiveness, it could emerge as a large economy that grows without destabilising others.

Eighty years on, Keynes’s warnings feel prophetic. His proposal was rejected principally by the US, then the dominant surplus economy, unwilling to give up monetary primacy. As a compromise, the International Monetary Fund emerged, but with more limited powers. Today, despite hosting many of the world’s largest and most innovative companies, the US faces deindustrialisation and a deteriorating trade deficit with China. The exorbitant privilege of the dollar enables sustained consumption supported by a de facto ‘Fed put’ that douses any shock with easy money. But while innovation thrives and corporate profits soar, much of the production happens offshore — decoupling technological progress from domestic industrial renewal.

This trade war is a repercussion of that broken global settlement. Keynes’s model would have strengthened the system by penalising imbalances, laying a more stable foundation for trade. Instead, we are saddled with a system governed not by comparative advantage, but by geopolitical leverage. From semiconductors to rare earths, globalisation is no longer shaped by the invisible hand of the market but by the administered hand of the State. In the near term, this shift will yield a more fragmented global economy where efficiency is subservient to strategic alignment. Goods, data, and capital will flow within rigid guardrails as trade blocs prioritise resilience, gradually eroding productivity and diminishing value for both producers and consumers. To restore trade’s potential to generate broad-based prosperity, we must return to the logic Keynes offered — perhaps not by recreating the Bancor but by recognising that shared institutions and balance-correcting mechanisms are essential. Any new framework must be grounded in the principle that imbalance breeds instability and that cooperation — not confrontation — is the path to global economic order.

In the decade ahead, the world would do well to pursue a system that fosters balance without conflict. India, straddling both advanced and emerging economies, must not only adapt to this shift but help shape it. If we can bring our scale, credibility, and democratic legitimacy to bear on the institutions of global trade, India could emerge not only as a beneficiary of the new order but also one of its architects.

Rudra Chatterjee is Chairman of Obeetee, Managing Director of Luxmi Tea, and writes on finance and economic issues