Guwahati, July 12: In a first-of-its-kind move, the Assam government will take people's suggestions while preparing the budget for 2016-17.

Finance minister Himanta Biswa Sarma today said the state government has adopted a "participatory model" to prepare the budget, inviting innovative ideas and suggestions from people which will be considered for inclusion in the budget.

Sarma has appealed to the people to email their innovative suggestions and ideas to suggest4assambudget@gmail.com before July 18 when the budget session of the Assembly will commence. The budget is scheduled to be presented on July 26 at 11am.

The previous state government had passed a vote-on-account instead of a full-fledged budget in February this year because of the Assembly elections. The minister said they have taken this step as the new government firmly believes that "governance without people's participation is not good governance".

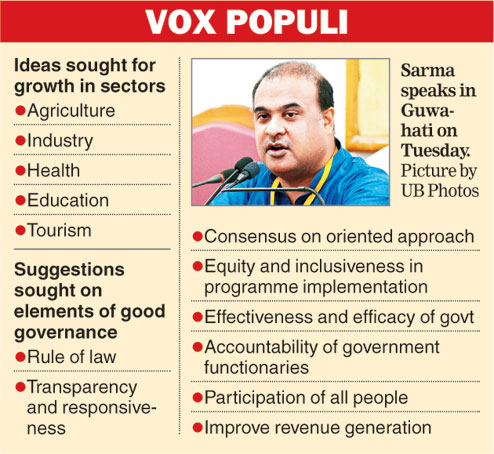

Sarma said they have sought people's specific suggestions for the budget on rule of law, transparency and responsiveness in governance, consensus on people-oriented approach, equity and inclusiveness in implementation of programmes, effectiveness and efficacy of the government, accountability of the government functionaries, participation of all people and measures to improve revenue generation. "We also solicit people's innovative ideas for improvement of economic growth of the state in the critical sectors like agriculture, industry, health, education, tourism and the like," he said.

Sarma said that the budget would contain certain proposals to give relief to the people from price rise. "Due to government intervention, the prices of as many as 33 medicines have come down in the past one week. After the budget is passed, the medicine prices will fall further."

On the increase of one per cent value-added tax on medicines, the finance minister reiterated that it would not lead to increase in the maximum retail price. "When the maximum retail price is fixed by a manufacturer, there always remains a margin to absorb any moderate tax hike. That is why one per cent increase in VAT will not cause any increase in price as the consumer will continue to pay the same MRP," he said.

"The hike in VAT is a tax on profits and we will ensure that the traders will not transfer it to the consumers," he said.

Sarma circulated a letter written by the Assam Medicine Dealers' Association stating that one per cent increase of VAT will not affect the MRP of medicines. He also advocated a uniform tax regime in the entire northeastern region to prevent diversion of trade.

"This problem of non-uniform tax regimes in the northeastern states, leading to diversion of trade from states charging higher tax rates to those charging lower rates, will be resolved when the goods and services tax (GST) comes into effect, possibly from April next year," he said.

"If that does not happen, then I will take the initiative and invite the finance ministers of all the northeastern states to prepare a uniform taxation policy for the Northeast to avoid any diversion of trade," he said.