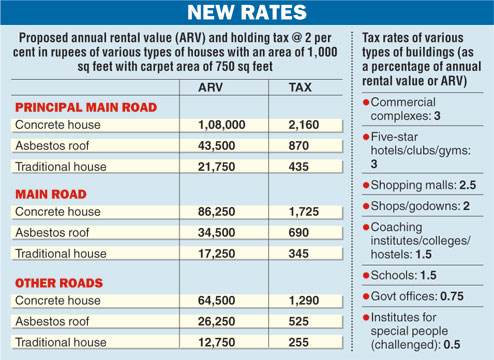

The board of Ranchi Municipal Corporation has agreed on annual rental values (ARV) of various types of buildings within its area and fixed annual property tax rates at 2 per cent (of ARV) with effect from April this year, ruling out the earlier proposal of charging 2.5 per cent annually with retrospective effect from April 2014.

At a special board meeting held on Wednesday, town commissioner Prashant Kumar said, "From now onwards house holding tax will be collected on total carpet area. The RMC has also decided to do away with various kinds of taxes incorporated in the house holding tax (like water tax, sanitation tax, health cess, education cess, totalling 43.75 per cent) and charge only house tax at the rate of 2.5 per cent of the annual rental value."

While ward councillors approved the recommended rates of annual rental value, but proposed that Ranchi house owners pay 2 per cent holding tax instead of 2.5 per cent.

The board also approved proposed holding tax rates of various other buildings, like commercial buildings, shopping malls, shops and godowns, educational institutes etc (see chart).

The new rates would now be sent to urban development department to be placed before minister C.P. Singh for his nod. He will then present the rates to the state cabinet, which would have to put its final seal of approval.

Mayor Asha Lakra congratulated the councillors for their positive attitude towards tax increase.

Deputy mayor Sanjeev Vijayvargiya said, "The board has clearly expressed what it wants regarding renewal of tax amount. Now, the government has to act accordingly."

Commissioner Kumar explained that after the new rates were approved, residents would be given new holding numbers.

"From now, holding number will be given under the four categories, namely, for land ownership, house ownership, flat ownership and super structures," he said.

Explaining how an individual could obtain a holding number, Kumar explained, "For a vacant land (without any construction) the owner will have to furnish the sale and rent receipts from the circle office. A house owner will also have to show the same documents. A flat owner in an apartment complex will have to furnish possession letter and old holding number."

Super structures, Kumar added, had been described as a building for which the civic body would not ask for land ownership papers, but would need an electricity bill for providing a holding number.

"However, it will be clarified in the holding receipts that the person in possession of the slip did not have ownership rights," he explained.

After the rates were finalised, RMC would press two tax collectors in each wards to help residents assess their tax obligations.