Rule changes preventing employees from prematurely withdrawing more than 75 per cent of their provident fund corpus, and delaying full withdrawals for those who have lost their jobs, have attracted charges that the government is stealing employees’ money.

However, Employees’ Provident Fund Organisation (EPFO) officials explained that locking in 25 per cent of the corpus till the retirement age of 58 had become necessary because frequent partial withdrawals by members was defeating the idea of social security. (See chart)

The decision to extend from 2 months to 12 months the period after which a member who loses their job can seek full PF withdrawal — if they continue to be unemployed — was made to avoid knee-jerk withdrawals, they said.

They clarified that a member can withdraw 75 per cent of their PF corpus immediately after the job loss, and has to wait 12 months only to claim the remaining 25 per cent.

The officials said this was for the member’s benefit — they might secure a job within that one-year period and may not need to withdraw the 25 per cent PF balance.

After the EPFO’s Central Board of Trustees took these decisions on Monday, Trinamool Rajya Sabha member Saket Gokhale termed them “open theft of salaried people’s own money”.

“Earlier, on losing your job, you could withdraw your EPF balance after 2 months of (un)employment. That minimum period has now shockingly been increased to 1 year,” he tweeted on Wednesday.

“Basically, for withdrawing your own money, you need to now be unemployed for a full year as opposed to only 2 months.”

On employees with full careers, he said: “And this is the worst part: Of your EPF balance, 25% cannot be withdrawn and will remain locked in for your entire career until you retire.”

Official data accessed by The Telegraph suggest that frequent partial withdrawals by EPFO members — on grounds of children’s education, marriage, illness, disability, disaster, emigration or closure of establishment — are seriously depleting their PF corpus.

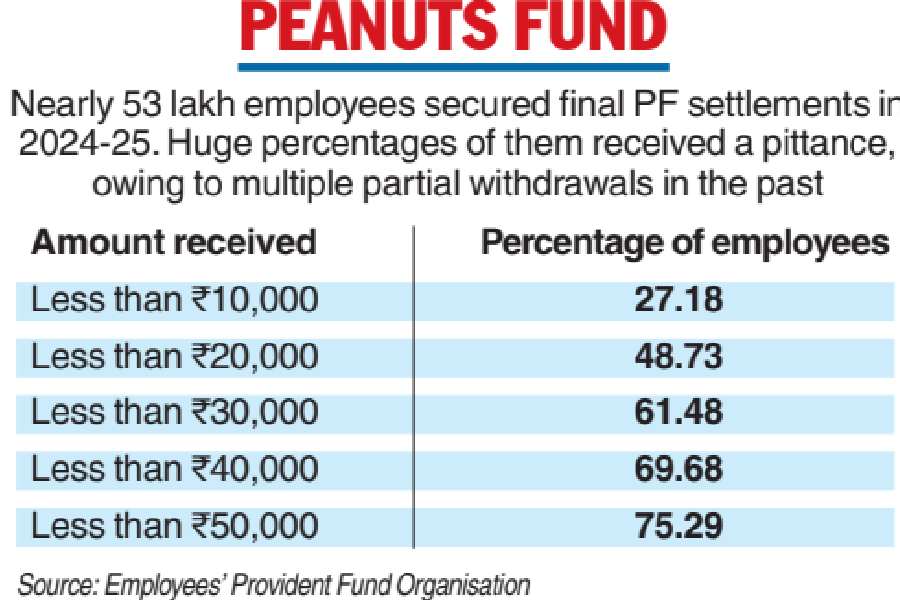

According to EPFO data, some 52.95 lakh members secured final settlements in 2024-25. Of them, more than 75 per cent received less than ₹50,000, with 48.73 per cent receiving less than ₹20,000.

About 1.29 per cent got between ₹5 lakh and ₹10 lakh, 1.01 per cent got between ₹10 lakh and ₹25 lakh and only 0.62 per cent got over ₹25 lakh.

An analysis by the EPFO says that for a member with an average monthly wage of ₹15,000 across a full career, the post-retirement PF corpus should be about ₹14 lakh.

With the new requirement to maintain a minimum balance of 25 per cent of the corpus, the member would stand to get at least ₹3.5 lakh on attaining retirement age.

“The idea of social security is eroded by frequent withdrawals,” an EPFO official said.

Pension grouse

Gokhale had another complaint. “You can withdraw the pension component of your EPF only after 36 months (i.e. 3 years) of unemployment,” he posted. “Earlier, you could do it after 2 months.”

Members receive a pension under the EPFO’s Employees’ Pension Scheme (EPS), funded by the employer’s contributions, if made for at least 10 years. Those employed for less than 10 years could, till now, withdraw the pension corpus as a lump sum two months after the contributions stopped.

This period has been extended to three years.

Officials said the idea is to enhance the social security of the member’s family if the member dies prematurely.

They said the EPS rules allow active membership (with interest deposited) for three years after contributions stop if the member has not withdrawn the pension corpus. If the member dies within the three-year period, an eligible family member will receive family pension.

The new three-year lock-in period aligns the withdrawal rules with the provision for family pension, the officials said.

EPS corpus withdrawal data for 2022-23 (for members whose employers’ contribution stopped before 10 years) suggest that 63 per cent of withdrawals happen within 3 years of the discontinuation of the contribution, ruling out family pension if the member dies soon afterwards, that is, within the three-year period.